What is Depreciation?

The older an item gets, the more its value decreases. It is because of the wear and tear with constant usage. The concept of depreciation follows this very idea. It can be defined as the reduction in the cost of a commodity, i.e. a good or a service, over time. In business, this refers specifically to that of a fixed asset. It comes about because we use the asset to the point where it cannot be used anymore.

You’d notice that when you buy a car, you can only sell it at a much lower price, even if you haven’t used it a lot. As a result, depreciation comes into play. This car being pre-used reduces its value instead of when it is brand new. The same concept is used for all other fixed assets such as machinery, furniture, etc. The exception to this is the fixed asset of land and property, of which the value consistently increases over time (this is called appreciation).

Types of Depreciation

There are several types of depreciation or methods used to calculate how much an asset should be valued after a particular period. The types differ based on the method of calculation. While we will look at the formulae slightly later, the types of depreciation are as follows.

Straight-line depreciation

Of all three types, this one is the simplest. It considers the shelf life of an asset, i.e. its working lifespan. By considering its cost price, we can easily calculate the annual depreciation. It does not use any complicated tools for calculation.

Declining balance depreciation

Some assets decline at an even annual rate, meaning they lose the same value every consequent year until it reaches zero. Declining balance depreciation is used when the decline is accelerated as each year passes. This decline of fixed assets is, thus, accelerated.

Double declining balance depreciation

It is similar to the declining balance type, but it takes a more aggressive approach to calculation.

Units of production depreciation

It is primarily used for machinery and assesses the production capacity of the fixed asset. By this, we mean that this method assigns a cost equal to each unit of production. The final depreciated amount changes annually.

Depreciation Formula and Calculation

Note that depreciation is an inherently mathematical concept with set formulae to be applied to practical situations. There are different depreciation formulas depending on the type that we’re looking at.

Straight Line Method

![]()

Where asset cost is the price at which it was bought, residual value refers to the price of the asset at the end of its lifespan, and useful life refers to how long the asset will efficiently work.

Declining and Double Declining Balance Method

Annual Depreciation=(Straight line depreciation percentage) x (Book value)

Where book value refers to the cost of the asset with its accumulated depreciation removed. For the double declining method, the total is simply doubled.

Units of Production Method

This method uses two steps – first we calculate the depreciation per unit produced by the asset. The second step calculates how much these units have depreciated over time.

![]()

Total Depreciation over time=Per unit depreciation × Number of units

Here, the value is calculated in terms of units produced and then its monetary value is found.

Depreciation Example for Reference

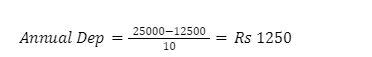

A sofa is bought for Rs 25,000 and its useful life is 10 years. The residual value after this is Rs 12,500. Thus, the depreciation calculated for this via the straight-line method would be as follows:

Each year, the value of this sofa will reduce by Rs 1,250 until it reaches 0 at the end of 10 years.

Conclusion

Depreciation is a vital concept in terms of business management. Company’s management needs to assess and reassess the value of their fixed assets on a timely basis. It helps ensure that all equipment, machinery and other assets are up to date. It also helps keep a tab on when new equipment will need to be bought and is thus imperative for planning and management.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out