Introduction

Consignment in accountancy is related to goods that are kept with an authorized third party who is called a consignee. This consignee is responsible for selling the goods on the behalf of the consignor. While the consignee sells the good in consignment, the ownership of the goods is retained by the consignor. There is a legal agreement made between the consigner and the consignee that facilitates the process of transactions. The involved terms and conditions of the agreement are also stipulated within this arrangement. Mostly, products like music, instruments, shoes, apparel, clothing, cosmetics, toys, and furniture are sold on a consignment.

Consignment

Under consignment, topics like consignment account, consignment tracking, and features of a consignment can be very important in examinations. Consignment accounting can be defined as a type of business organization where an individual or individuals sell goods to customers through the medium of intermediaries on their behalf.

Consignment Meaning

Consignment in accountancy is related to goods that are kept with an authorized third party who is called a consignee. Under consignment, topics like consignment account, consignment tracking, and features of a consignment can be very important in examinations. There are certain features of consignment which are:

- Two parties- The consignor and consignee are involved in this process

- No ownership transfer- the ownership is retained by the consignor

- Agreement- an agreement is made during consignment that facilitates the process of transactions

- Separate accounting- Accounting is done independently Consignment accounts are prepared separately and entries are made on an individual basis in accounting records

- Procession transfer- Goods are transferred from the consignor to the consignee who does the selling

- Reconciliation- Annually or periodically Consignors give Pro-forma invoices

- Consignee sends records of the sales and then reconciliation is done

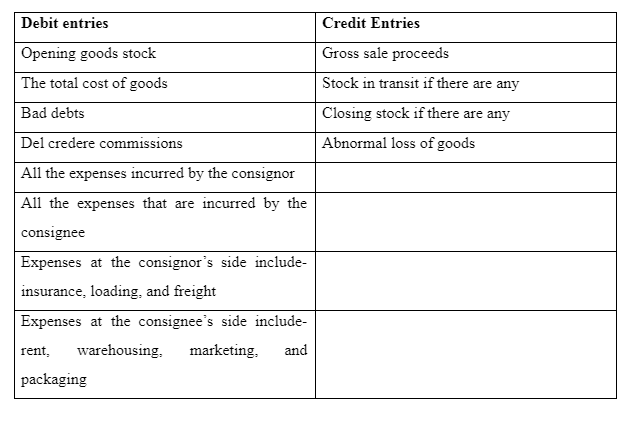

Consignment Account

A consignment account can be created when it is required to ascertain the number of profits and losses incurred on given assignments by the consignor that is related to the consignment. The consignment account is created nominally. It shows the outcomes of the consignment business that took place over some time. In a consignment account, there are debit and credit entries that are made based on account sales which are in turn provided by the consignee.

Consignment Tracking

Consignment business greatly depends on curating the inventory tracking accurately. Tracking begins when reliable records of the entire consignment process were already carried out properly. Consignors’ merchandise that is incoming and recording items’ price sale date and number are essential components of keeping a good track on consignment tracking. Reliable consignment tracking is therefore important to reduce the chance of discrepancies that can lead to loss of revenues. This can also prevent consignor-consignee disagreements.

Here are some useful consignment tracking methods:

- Paper Tracking Systems

- Consignment Software Program

- Radio Frequency Identification Tracking System (RFID)

- Spreadsheet Tracking

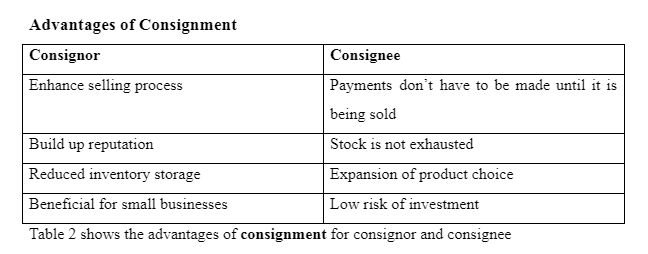

Advantages of Consignment

Conclusion

Consignment in accountancy is related to goods that are kept with an authorised third party who is called a consignee. This consignee is responsible for selling the goods on the behalf of the consignor. It shows the outcomes of the consignment business that took place over some time. While the consignee sells the goods in consignment, the ownership of the goods is retained by the consignor. There is a legal agreement made between the consignor and the consignee that facilitates the process of transactions.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out