A company’s most frequent transactions involve the receipt and payment of money, the sale of goods, or both. Keeping separate registers for each of them is a practical solution. Books of Accounts is a record of this kind and is the most important document for performing further accounting procedures. Assets, liabilities, incomes and expenses are tracked in these accounts. As a general rule, the term “book of accounts” is most commonly used to describe the general ledger in double-entry accounting systems. All of an organisation’s accounts, along with their current balances, are part of the general ledger.

Books of Accounts

Books of Accounts is a record of all financial information about a business or an organisation.

Classification of Financial Books

Principal Books of Accounts – These books provide information for the preparation of Trial Balance and financial statements. Principal Books include:

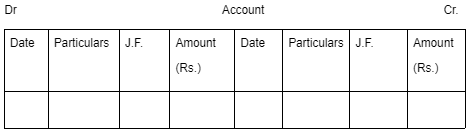

- Ledger – Ledger is the name given to the book that contains all of the accounts (personal, real, and nominal) in one place

The format is:

- Cash Book – Cash Book serves as both cash and bank account and balances are entered directly into the trial balance in this instance

- The Cash Book is included in the ledger and it must be treated as the Principal Book

Subsidiary Books of Accounts– Subsidiary books are the books in which transactions are first recorded to facilitate processing. It includes:

- Cash Book – Accounting records cash transactions in the Cash Book and reconciles them with those recorded in the ledger

- It is therefore also a Subsidiary Book

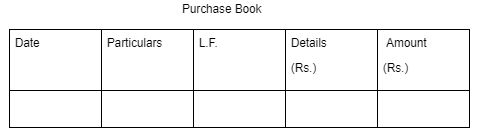

- Purchase Book – The Purchases Book is a separate register used to keep track of the purchases of goods traded or materials and stock used in the factory

The format is:

- Sales Book – The Sales Book keeps track of credit sales of goods

- Credit sales of items other than those sold by the company are not recorded in the Sales Book

- The format is the same as the Purchases Book

- Purchase Returns Book – It keeps a record of returns of purchases of goods

The format is the same as shown above.

- Sales Return Book – It records returns made to the company of goods sold

The format is the same

- Journal Proper – Miscellaneous entries that don’t fit in other books are recorded in the general journal

Types of Books of Accounts

- Journal for Keeping Track of Transactions – The first documentation of any transaction is done via the Journals.

- Here, accounts are debited and credited based on the transaction with the particulars as well as the amount.

- Ledger – Keeping track of financial transactions is done in a ledger.

- It is done after journaling to categorize transitions based on the accounts of the effect.

- Cash Book – The only transactions that are recorded in a cash book are those that involve cash.

- General Ledger – All financial transactions of the business are recorded in the general ledger.

- Debtor Ledger – It provides details of the sales on credit made to customers.

- Creditor ledger – A creditor’s ledger is a record of all of the purchases made in credit from Creditor.

- It is a book-keeping worksheet in which all ledgers are combined into debit and credit account column totals that are equal.

- For the most part, a company’s book-keeping entries need to be tested for accuracy using a trial balance.

Financial Statements and Records

There are several types of documents that are included in the term “Financial Statements and Records,” such as those required by law or any government.

- Balance Sheet – It is a financial statement that shows a company’s assets, liabilities and shareholder equity at a given time. A company’s balance sheet serves as a basis for calculating investor returns and assessing its capital structure. The balance sheet is a financial statement that shows the assets and liabilities of a company, as well as the amount of money invested by its shareholders.

- Statement of Profit and Loss – A statement of profit and loss is a financial statement that summarises the company’s revenues, costs, and expenses for the period.

- Trading Account – The firm’s trading activities take place on the trading account. Net sales and the cost of goods sold are two of the most common entries. Gross profit or gross loss is determined by this.

- Cash Flow Statement – A cash flow statement is a financial statement that shows how much money is coming in and going out of the business. Over time, it serves as a gauge of how well a company has been doing in comparison to its peers.

- Bank Reconciliation Statement – Financial records and bank accounts are reconciled by a bank reconciliation statement, which is a summary of banking and business transactions. Deposits, withdrawals, and other account activity for a specific period are detailed in the statement.

Book – Keeping

Bookkeeping is the systematic and meticulous recording of financial information about a company’s operations. It encompasses both the technical and procedural aspects of accounting work, as well as the role of record keeping. To put it another way, book-keeping procedures are dictated by the financial statements they produce. Keeping track of transactions and events also necessitates proper categorisation. The foundation of accounting is a well-organised Book-Keeping system.

Process of Bookkeeping

- Detecting and tracking financial transactions

- Recording transactions in the Journal

- Ledger accounts preparation

- Preparing a Trial Balance

- Pass adjusting entries

- Preparing Adjusted Trial Balance

- Financial Statement preparation

Relationship between Accounting, Bookkeeping and Accountancy

Many people confuse the terms “Bookkeeping” and “Accounting,” but they are not interchangeable. Accounting and Bookkeeping both are parts of Accountancy. Further, Bookkeeping is part of Accounting. There are many different types of accounting. It necessitates a deeper understanding of Book-keeping records and the ability to analyse and interpret the information they contain. The recording phase of an accounting system is the purview of Book-keeping, whereas the summarising phase is the domain of accounting. Accounting relies on the data provided by book-keeping, and the accounting process begins where book-keeping concludes.

Conclusion

Keeping track of everything a company does is essential. To keep track of these transactions, the company must maintain Books of Accounts which are classified as Principal books and Subsidiary books. Books of Accounts are maintained by BookKeeper who performs the routine nature task Book – Keeping. These records are further analysed and interpreted by Accountants to produce meaningful financial information.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out