When a business returns a sale order to a vendor, the transaction is recorded in the sales return book. Occasionally, a customer may return a product for various reasons, including poor quality, incorrect quantity, late delivery, and more. Returns inwards are sales returns that have been properly recorded in a sales return or return in the inward book.

Calculating Sales Returns in a General Ledger

- In the sales account, debit the amount of the return

Debits go in the left column of the ledger, and credits go in the right. It is a common procedure in the accounting world. Record the debit in the left column because the return debits the sales account.

- Record the credit in the inventory account

As a result of the return, the account’s levels on the right side of the column increase.

- In the restocking account, deduct any costs associated with restocking merchandise

Again, this record is in the left column because it deducts money from this account. If you charge a customer a restocking fee, record it as a credit.

- Determine if the sales return affects other accounts and make the proper ledger entry

Debits in the sales and restocking account get recorded in the merchandise account. However, it also affects the cash account due to decreased cash levels. There is also an adjustment for the amount of money lost due to sales returns, deducted from the cash account and then credited back to it because the customer must bear the restocking fee.

Posting from Sales Returns Book

There are two steps in posting a transaction to a ledger after recording in a sales returns book:

- Posting to debtors’ accounts

Daily, write the words ‘By Sales returns account’ on the credit side of the debtor’s account for each sale return entry.

- Posting to sales return accounts

After the month ends, write to Sundry Debtor A/c on the sales returns debit side.

Credit Note

If goods are returned, the seller prepares and sends the buyer a credit note, which indicates credit in the buyer’s account. When customers return goods to a merchant, they issue a credit note, including information about the buyer’s returned goods, quantity, and value.

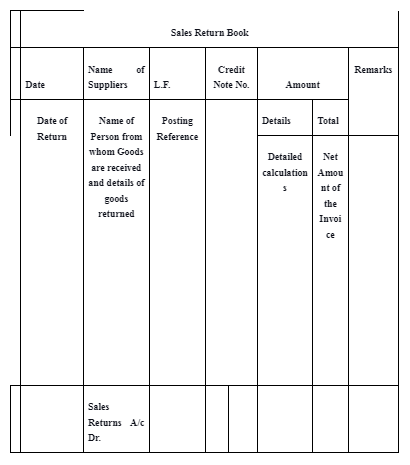

Following is the sales return book format

Reasons for Sales Return could include:

- If the invoice has an error

- If the goods are defective, the seller is ready to lower the price rather than require a return

- If the invoice doesn’t provide enough trade discount, or if the seller agrees to increase the trade discount rate after issuing the invoice

When issuing an invoice to the customer, there is a debit from the customer’s account. Therefore, the seller must credit the customer’s personal account for returning the goods or reduce the amount charged by an invoice to reduce the debt in the account.

A credit note is what he uses for this purpose. A credit note is thus the opposite of an invoice. The difference between an invoice and a credit note is that an invoice makes the customer legally responsible for payment, while a credit note relieves him of that responsibility.

In the returns inwards book, customer credit notes must be recorded. Record credit notes issued for any reason (return of goods, correction of an error, or additional trade discount) in the sales return book.

Sales Returns Types

- Cash refund sales returns

Refunds for customers who return products and receive cash are in this category.

- Credit-Memo sales returns

In this case, the customer returns the item and receives a credit memo to use on future purchases.

- Store Credits

Due to the return of certain products, retailers often offer discounts on those products.

Sales Return Profit Impact

The sales return is not authorised until after completing the original sale transaction and reporting an excessive revenue in the original period, with an offset later. It results in an overstatement of profits in the first period and underestimating profits later.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out