How to login into the EPFO member portal-

For employees-

- Employees first need to go to the official website.

- Under this, they will get the option ‘services’ and then ‘for employees’

- The next page will open and you need to click on ‘ Member UAN/Online Service (OCS/OTCP)

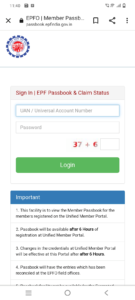

- A new page will open where you have to enter your UAN and the password and also the captcha asked to fill.

- By clicking on ‘sign in’

- You are welcome to the page where you can know anything about KYC, PF account etc.

For Employers-

- First employers need to go to the official website.

- Under this, they will get the option ‘services’ and then ‘ for employers’.

- After telling the ‘username’ and ‘password’ you can simply ‘sign in’.

- After this detail, the home page will open where employers can fill and check the details of their employees as per their requirements.

EPFO and its applicability-

Structure of EPFO-

It works in many zones. Currently, it is being operated in 10 zones. Each zone is governed by the Additional Central Provident Fund Commissioner. If a state has one or more than one regional office, that will be headed by the grade -1 officer called the Regional Provident Fund Commissioner. Every region can be categorized into subregions for the sake of better efficiency. A district office will be maintained at the district level.

Functions of EPFO-

EPFO has been given many important works regarding the management and proper strategy utilising the funds properly. The main function of EPFO is taking care of pension accounts and providing them with their funds when needed. It works to settle the claims of the account holder of EPFO. It also keeps its record updated to use them whenever needed. It also invests the final amount of account holders to give them high benefits.

Way to download the passbook-

- First, you need to go to the website

- You will find the area on the page to fill in the information of UAN number and password.

- After filling in the details, it will ask you to add a number just to check if you are not a robot, just add this asked simple numbers.

- The next page will open and you will find an option to download your passbook.

Services Provided by EPFO

EPFO, commonly known as Employees’ Provident Fund Organisation, is a statutory body which is formed by the government of India. It provides social security to the employees of organised and unorganised sectors. This body encourages people to save a small amount of money for the retirement period, which can be paid to them as a pension. This body is managed by the ministry of labour and employment and was founded in 1951. The EPFO actually plays a role in providing social security to the workers of the country. According to the Indian constitution, an Indian state is a welfare state and must provide its citizens with the benefit of social security. The main role of EPFO is to provide employees with the opportunity of a provident fund. A part of the salary usually gets deducted, which is put into the respective employee’s provident fund account. This money is later paid to the employees with interest as a form of pension. The employee can also acquire a loan from the provident fund in case of an emergency. Another major role of EPFO is to enact the provident fund law all over the country except Jammu and Kashmir and provide all the employees with the benefit of the provident fund. It also manages several other functions, such as settling the claims of the employees, maintaining the individual person, investing funds for the initiative, and last but not least, ensuring a fast pension for all the beneficiaries. It also keeps the records of all the beneficiaries and also updates the records with time. The agency also implements different security agreements with other countries. Basically, in terms of the number of financial transactions and the number of beneficiaries, it is the largest social security organisation in India. The EPFO has a trustee body which consists of both government officials and members of parliament, which manages all the financial activities. Recently, the body has implemented digital methods and IT-managed tools to manage all the activities of the body. So, EPFO works as both an administrative body and a financial transaction body. It also provides financial services to millions of beneficiaries. All of the information regarding EPFO’s services and other information can be found on their official website. EPFO provides a unique account number to all of its beneficiaries, which is known as the UAN (Universal Account Number). It links the IDs of the beneficiaries to their accounts, and the employees can easily avail different online services provided by EPFO. The online service includes providing passbooks of the provident funds, updating them, sending messages when money is credited to the provident fund accounts and auto transfer of the provident fund account in case of any change in employment. In February 2015, the agency set up a helpdesk to provide necessary guidance and help to all the concerned beneficiaries. This digital portal helps every beneficiary to keep track of their accounts at their fingertips. It also helps to settle their claims and get their pension on time. Even if the beneficiary wishes, he/she can withdraw the full provident fund account.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out