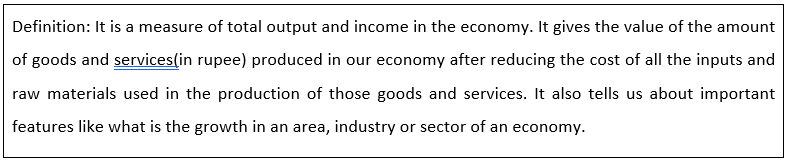

Gross Value Added (GVA) is an important economic indicator for any country. It depicts the current state of the economy as a whole, serves as an important performance metric, and aids in the formulation of economic, regional, and sectoral policy decisions.

GVA gives a clear idea about the state of economic activity from the producers’ side or supply-side perspective. It measures the contribution to the economy of each individual producer, industry or sector in India and is used in the estimation of GDP.

GVA gives us the difference between output and intermediate consumption for any particular sector/industry of the economy. The difference between the value of goods and services produced and the cost of raw materials (and other expenses) that are used up in production.

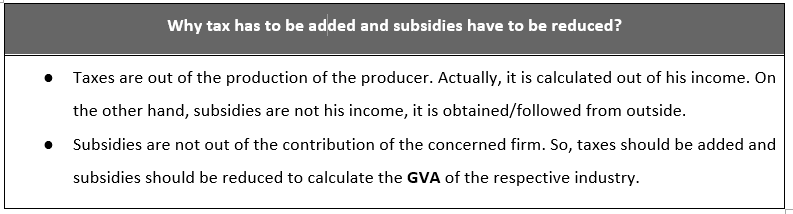

GDP is another name for GDP at basic prices. It is a measure of the total value added by all industries which shape the economy, but it does not include the value of different taxes or subsidies on products (VAT and excise duties), which are paid by the consumer. Whereas total GDP at market prices includes these taxes and subsidies on products (GDP = GVA + taxes – subsidies).

Basically, GVA apprehends what to attend to the producer, before a product is sold. While GVA tells us about the state of economic activity from the producers’ side, GDP gives the picture of the economy from the consumers’ side. Both measures need not match exactly because of the difference in the calculation of net taxes.

It is worth mentioning that in real terms there is rarely any notable difference between growth rates and growth media.

GVA at basic prices = GDP at factor cost + Production Taxes – Production subsidies

Here, GVA at basic prices = GDP at factor cost + Production Taxes – Production subsidies

Production taxes include Stamp duties, registration fees, property taxes etc.

Production subsidies include subsidies to labor, capital, and investment – called factors of production such as apprentice subsidies and interest subsidies. Production subsidies are different from Product subsidies. Production taxes and subsidies are paid or received per unit production of the product. Excise duties, sales tax, service tax etc. are examples of product tax. Some examples of Production subsidies are Food, fertilizer and fuel subsidies which are provided per unit.

Understanding GVA:

- Understanding GVA a simple way to explain GVA is to think of it in the context of the manufacturing process

- During a manufacturing process, goods, energy, and services are dealt with

- The associated costs are termed ‘intermediate consumption’

- At the end of the (production) process, the business has a product for sale or for its own use

For example, if we get a wooden chair as our output then: Intermediate process includes the cost of wood, glue, screws, and other different raw materials used in its manufacture, the cost of rental, utilities, transport, legal and business services, insurance, marketing, and other things are also included.

Selling the product (Output) generates revenue which helps to meet costs associated with the production of the product (Intermediate Consumption) can be met.

- The firm’s GVA is calculated as the balance of Output less Intermediate Consumption.

Importance of GVA:

- Explore the contribution of different sectors and industries to the economy

- At different geography levels, analyze the regional spread of economic products

- Produce productivity data, in concurrence with other datasets

- Highlight the absolute impact of a policy interposition, at both gross & net levels

- The ‘impact investment ratio’ should be calculated – an index of the relative effectiveness of an intervention

- Either through comparisons of the wage component of GVA or through comparisons of GVA per employee, help assess the ‘quality’ of jobs generated

Important Points:

- While GVA tells us about the state of economic activity from the producers’ side, with the help of the GDP, we get to know the picture from the consumers’ side

- Because of the difference in the calculation of net taxes, it is not important for both measures to match exactly

- Policymakers have to decide which sectors need incentives and stimulus or which sectors do not need it

- A sector-wise breakdown collected from the GVA result can help them to decide

- Some consider GVA as a better measure of the economy because a sharp increase in the output may distort the real output situation

- It happens only due to higher tax collections which could be on account of better compliance or coverage

- A sector-wise breakdown provided by the GVA measure helps policymakers decide which sectors need incentives or stimulus and accordingly prepare sector-specific policies

- But GDP is an important measure when it comes to making cross-country surveys and comparing the incomes of different economies

GVA Estimates by National Statistical Office (NSO):

- As part of the GVA data, the NSO provides both quarterly and annual estimates of output

- It is measured by the gross value added by economic activity

- The sectoral classification provides data on eight broad categories that stretch the range of goods produced and services provided in the economy

- These are: 1)Manufacturing; 2) Mining and Quarrying; 3) Agriculture, Forestry and Fishing Manufacturing; 4) Construction; 5) Electricity, Gas, Water Supply and other Utility Services; 6) Trade, Hotels, Transport, Communication. Some broadcasting related services; 7) Real Estate, Financial and Professional Services; 8) Public Administration, Defence and other Services.

Issues with GVA:

- The accuracy of GVA as a measure of overall national output is heavily dependent on the sourcing of data and the constancy of the various data sources (as with all economic statistics)

- GVA is responsible for susceptibilities from the use of inappropriate or wrong techniques

- Economists debate that India’s switch of its base year to 2011-12 had resulted in a significant overestimation of growth

- The measurement of the formal manufacturing sector gets affected because of the value-based approach. Instead of that, GVA estimation should have been used

- This has affected the outcome of the manufacturing sector very badly

Conclusion

With the concept of such costs and prices in place, students will be able to learn the nuances of this subject more effectively. Because gross value is one of the most important subjects in economics, it is critical for students to learn and understand it thoroughly.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out