Lintner’s Model was proposed by professor John Lintner from Harvard Business school after he interviewed 28 large firms. His study proposed an organisation’s current dividend on its current annual earnings and previous year’s dividends. In his proposal, Lintner assumes that every organisation has set dividend policies, and he also assumes that the organisation wants to maintain a constant dividend rate. Lintner observed that most organisations set target dividends to earnings ratios using the present net value, and the earnings increases are not sustainable; thus, changes in the dividend will occur when there is a sustainable increase in the earnings.

Lintner Dividend Model

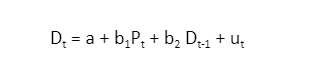

The dividend is defined as dividing annual organisational earnings among the shareholders. The common dividends distributed include cash, stock and property. In a cooperative organisation, a dividend policy is highly sensitive and complicated. Lintner’s Dividend Model was developed to explain the behaviour of dividend policy. The model addresses two main determinants of dividend payout: recent earnings and previous dividends. According to the model, if an organisation follows its target payout ratio, the dividend will change whenever the earnings changes. The dividend payout is the current net income after tax and the lagged dividend (last year’s dividend). Lintner’s Dividend Model uses the following formula –

Dt represents the total equity dividend. t represents time.

Dt-1 is the sum of the equity dividend in a span of t-1.

Pt is the current net earnings after tax. This represents an organisational capability to pay the dividend to the stakeholders.

Ut is the error term.

Lintner’s Model assumes that an investor prefers a substantial dividend payout. The dividend payout to the stakeholders is dependent on current net earnings and the sustainability of the earnings. An increase in net earnings will increase the dividend paid to the stakeholders. Lintner’s Model was formulated after interviewing 28 large firms, and it helps an organisation to understand the trend of its dividend.

Through Lintner’s Dividend Model, an organisation can identify a possibility of reluctance in different parts of the management. The model enables an organisation to achieve the laid payout plan in the long end. To ensure stability in dividend rate, organisations make partial changes to the rate annually depending on the change in the earnings.

Lintner’s Model – assumptions

Lintner’s Model assumes that the capital market is perfect in that all investors are rational, information is freely available, and securities are infinitely divisible. According to the model, every investor can influence the market prices of securities, and there is no floatation cost. The tax rates applicable to capital gains and dividends are not different.

The assumptions of Lintner’s Model are unrealistic and unattainable in reality. The approach used in the calculation of the dividend payout is questionable on account of the capital market’s imperfections and the resolution of uncertainty.

Organisational dividends setting

The organisational board of directors develops the dividend policy that entails payout rates and distribution dates. An organisational dividend policy follows the following three main approaches.

The residual approach – Dividend in this approach comes from leftover equity, which results after meeting all project requirements. Organisations that use this approach always ensure that debt-to-equity ratios are balanced.

The stability approach helps reduce the uncertainty among investors and gives them a stable source of income. In this approach, the organisation divided the dividends into four sets annually.

The third main approach is the hybrid, a combination of residual and stability approaches. An organisation that uses the hybrid approach considers the debt-to-equity ratio as a long-term goal. The stability approach is used in cases when the current income exceeds the general levels.

Sharpe Lintner Model

It is essential to measure the cost of equity capital in an organisation, and the process is long and tiresome if done manually. The Sharpe Lintner Model explains the securities in the financial market prices and helps determine the expected return from the capital investment. The model helps quantify risks and translates them into the expected return on equity. The model is based on two assumptions: competitiveness and efficiency of security markets and the domination of the security markets, which are rational and risk-averse investors. The securities market’s assumption supposes that the market has well-informed buyers and sellers. The other assumption supposes that investors would prefer more returns from the investment.

Advantages of the Sharpe Lintner Model

- The model gives the nature of the estimated cost of equity expected in an investment.

- The financial manager can use the model to supplement other techniques to develop a reliable and useful cost of equity.

Assumptions of the Sharpe Lintner Model

The model assumes that the number of investors in the market have the same information and that they agree on the risks and anticipated returns from the assets. An individual investor cannot influence the prices of the investments. The model has no transaction costs and taxes, and it assumes that all investors are looking for market value efficiency.

Conclusion

Dividend payout is an essential part of every organisation’s financial policy. Various organisations adopt Lintner’s Dividend Model to help them understand the behaviour of dividend payout. Lintner’s Model focuses on the current net earnings and the previous year’s dividend. The Sharpe Lintner Model explains how the securities in the financial market prices are and helps determine the expected return from the capital investment. The Sharpe Lintner Model helps evaluate the risks of an investment and the expected capital returns. Organisations can use the Sharpe Lintner Model to evaluate the risk and the expected returns before making any investments.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out