Introduction

- The Reserve Bank of India (RBI) is the country’s central bank. It is the regulator of the entire banking system in India.

- The Reserve Bank of India was established on April 1, 1935, following the passage of the RBI Act 1934.

- The purpose of the RBI Act 1934 was to issue notes and maintain reserves, but the Act did not cover Banking Regulation.

- Until 1949, when it was nationalized, the Reserve Bank of India was a privately held bank.

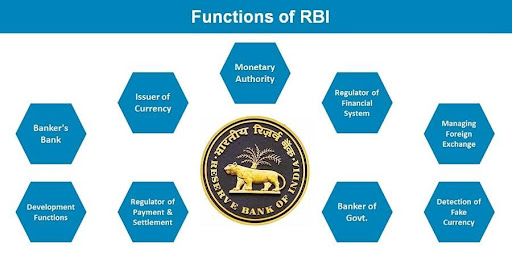

Functions of the RBI

- The issuer of currency: The Reserve Bank of India is the sole agency in India that can issue currency and coinage, with the exception of the One-Rupee coin and note, which are both issued by the Finance Ministry. RBI prints and distributes currency along with regulation of the flow of currency in the economy.

- Banker of Government: The Reserve Bank of India (RBI) provides banking services to both the Central and state governments. These services include deposits, loans, etc.

- Bankers to the banks: RBI as the Central Bank of India, supervises the Commercial Banks of the country. RBI provides various services to these banks like loans to meet

short and long term liabilities, issue licenses to Banks and Lenders of last resort etc.

- Inflation targeting: RBI is tasked with the function of stabilizing the rate of Inflation.

- Regulator of foreign exchange: RBI stabilizes the value of Indian currency in the global economy. RBI manages India’s foreign currency assets and gold reserves.

- Developmental functions: RBI ensures credit availability to productive sectors, promotes financial inclusion, sets up various institutions like SIDBI, NABARD etc.

- Other functions: The Reserve Bank of India (RBI) represents the Indian government at the International Monetary Fund (IMF), controls credit and monetary policy, and publishes monetary and banking data, among other things.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out