Introduction

- It is the amount of broad money that banks generate with each rupee of reserves or base money available with them. Here, reserves are the amount of deposits that the RBI requires banks to hold and not to lend.

- It depicts the relationship between the monetary base and the economy’s money supply and it tells how fast the money supply from the bank lending will grow.

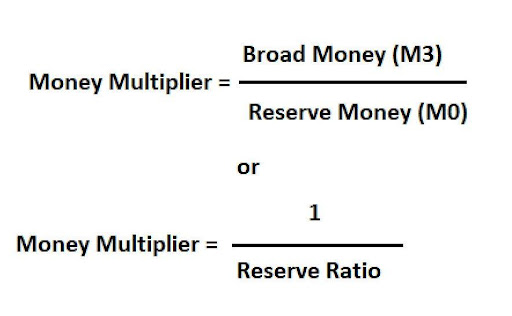

Formula for calculating Money Multiplier

- Money Multiplier is the ratio of the Broad Money (M3) to Reserve Money (M0).

- The higher the reserve ratio is, the less deposits will be available for lending, resulting in a smaller money multiplier and vice versa.

- Thus, higher the value money multiplier, higher will be liquidity in the market and Vice Versa.

- It is important to note that the reserve ratio is also known as the Legal Reserve Ratio (LRR) which is the minimum ratio of deposits that is legally required to be kept by the commercial banks with the RBI.

Legal Reserve Ratio (LRR)

- There are mainly two types of Legal Reserve Ratio (LRR). They are

- Cash Reserve Ratio (CRR): CRR is the minimum percentage of a commercial bank’s total deposits which they are required to keep with the central bank or the RBI.

- Statutory Liquidity Ratio (SLR): SLR is the minimum percentage of the net total demand and time liabilities which are required to be maintained by the commercial banks themselves.

Multiplier Effect

- It is the change in income level to the change in spending. It means, a proportional increase or decrease in final income that results from an injection, or withdrawal, of capital.

- The Multiplier Effect significantly assists in measuring the impact of changes in various economic activities such as investment or spending and what it will have on the total economic output.

Multiplier = Change in Income/Change in Spending

- The multiplier effect is mostly taken from a banking and money supply perspective by economists and bankers.

- The size of the multiplier depends on the percentage of deposits that banks are required to hold as reserves.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out