One of the important things that have happened in the financial environment of the country is the rapid growth of Development Banks. Development Banks unlike regular banking institutions focus on the provision of medium and long-term finance. An important aspect of the working of these banks is that they encourage private entrepreneurs by supplying long-term finance to them. Their purpose is to do activities that develop the Indian Economy. As shown by their name, they supply finance for development activities.

Difference of Development Banks from the other Commercial Banks

Development Banks differ from commercial banks in three important aspects:

- They do not accept deposits from the members of the public.

- They specialize in the supply of medium and long-term finance, while commercial banks focus on short-term finance.

- They do not just focus on selling loans but also on the development aspects of their projects.

As the phrase Development Banks suggests, they aim to promote economic development in their assigned environment – agriculture, industry, manufacturing, or any other. They aim to promote enterprise and entrepreneurship by supplying investment. They promote enterprise in several ways like – supplying risk capital, arranging loans in foreign currencies, underwriting public issues, preparation, and evaluation of project reports, investment project identification, creating avenues for technical advice, provision of management services, identification, and supplying market information to the businesses.

While the development banks have several lofty goals, it all depends finally on the kind of technical expertise that they manage to inculcate into their eco-system along with the staff capabilities and also their individual experience. They are not fully developed to supply the complete spectrum of services. The Development banks have played an important role, however, in the supply of long-term finance to businesses and several private large-scale industries have benefitted from them immensely.

Activities of Development Banks

The Development Banks in India supply four important services to the private industry:

- Long term finance for promoting economic growth of the country by way of Term loans and advances

- Subscriptions to the Initial Public offers (IPOs)

- New IPO underwriting, and

- Supplying guarantees for terms loans and other deferred payments.

The first two of the above give liquidity directly to the promoters, while the second two allow the promoters of enterprise to raise funds from other sources by the support from Development Banks. What needs to be appreciated in the context of the guarantees that the Development Banks supply is that the other creditors are satisfied that their lending is protected due to the guarantees provided by the Development Banks. From the perspective of the Development Banks, their guarantees do not lock up their funds. These guarantees are cashed only in contingent situations. Supplying guarantees also attract funds for the Development Banks themselves.

Structure of the Development Banks in India

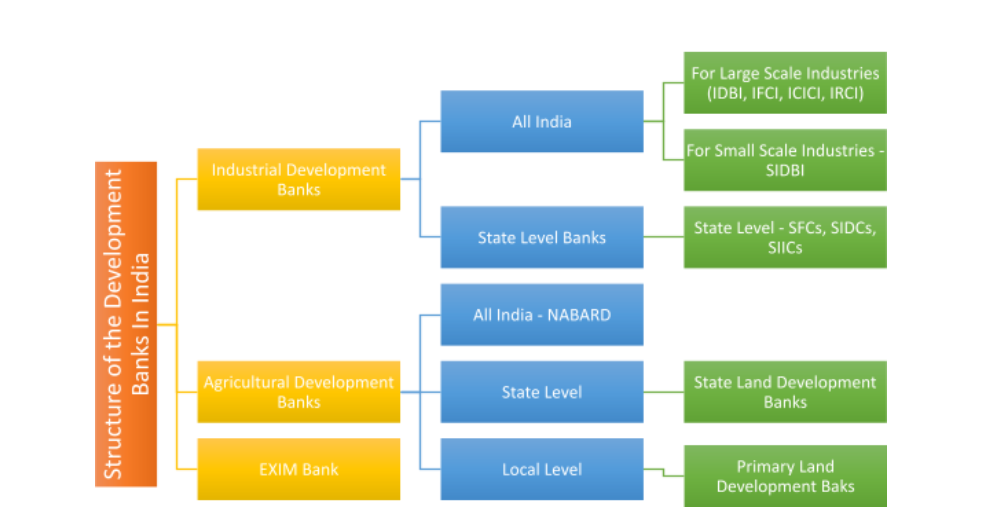

Development Banks were set up in India only after independence was gained. Earlier there were only land development banks. There are several development banks in India, some of them focus on industrial development, some focus on development in the agricultural arena, and one focuses on the development of foreign trade. Few of the banks run across the country, while others are either focused on the development of one district or a few even smaller geographical areas. To make it easier the following is the structure of the development banks in the country:

Abbreviations Used in the diagram above:

EXIM Bank: Export-Import Bank

NABARD: NAtional Bank for Agricultural and Rural Development

IDBI: Industrial Development Bank of India

IFCI: Industrial Finance Corporation of India

ICICI: the Industrial Credit and Investment Corporation of India

IRCI: Industrial Reconstruction Corporation of India

SIDBI: Small Industries Development Bank of India

SFC: State Finance Corporation

SIDC: State Industrial Development Corporation

SIIC: State Industrial Infrastructure Corporation

It is said that the development banks around the world have been set up only after the second world war both in the developed and under-developed countries. Development Banks play a more critical role in developing countries because the governments want economic development at a faster pace. Development banks do not mobilize resources, they instead focus on spreading their resources in a meaningful manner.

Conclusion

The Development Banks play a key role in supplying medium and long-term finance to their assigned sectors of industrial development, agricultural development, infrastructure development, export-import, and land development activities. Unlike commercial banks, they do not accept deposits from public.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out