What is Pradhan Mantri Suraksha Bima Yojana?

A government-backed accident insurance scheme that covers accidental death, permanent disability, and partial disablement is provided by the Pradhan Mantri Suraksha Bima Yojna. It is eligible for individuals between 18 and 70 years to apply for this scheme. This Indian government’s accidental scheme was announced during the 2015 budget. This scheme was granted to provide personal accident insurance to the high-risk section such as mechanics, labourers and truck drivers which involves a lot of travelling. It is also the cheapest insurance cover. It covers the partial and permanent disabilities.

The age category between 18 and 70 must have a bank account. After excluding the service tax, the annual premium of the PMSBY will be Rs 12. This premium amount is directly debited from the bank account of the scheme holder. If the subscriber dies in an accident or if he is fully disabled Rs. 12 lakh is paid to the nominee and Rs.1 lakh is paid if the subscriber meets with an accident and suffers partial permanent disability.

Features of PM Suraksha Bima Yojana

The features of PMSBY are mentioned below.

- The renewable is covered by accidental death insurance each year.

- Excluding the service tax which is charged at 14%, the annual premium to be paid is Rs.12.

- If he or she dies in an accident or is totally disabled due to the accident then, up to Rs.2 lakh cover is payable to the nominee of the subscriber.

- The subscriber can use the long-term option or renew the scheme each year.

- It provides the option for exiting the scheme at any time and can sign up at any time in the future.

- The amount is auto-debited from the bank account of the subscriber.

Benefits of PM Suraksha Bima Yojana

- Rs.2 lakh is paid to the nominee if an accident causes the subscriber’s death

- Rs.2 lakh is paid, if an accident leads to a total and irrecoverable

- Rs.1 lakh is paid, if the total loss of sight of one eye and loss of use of one hand or foot happens due to an accident and leads to no recovery.

- Under Section 80C for the premium paid the subscriber can also avail of deduction

- Under Section 10(10D) the sum insured received up to Rs.1 lakh is tax-free

PM Suraksha Bima Yojana – Eligibility

There are some eligibility criteria for applying this scheme and these conditions are given down below.

- The minimum age limit for applying is 18 years.

- The maximum age limit for applying is 70 years.

- Those who fall under this age criteria must have a savings bank account to subscribe to the policy.

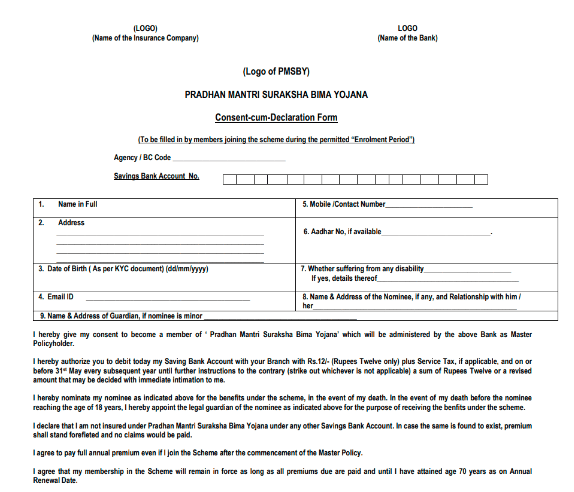

- The Aadhaar card must be linked to the bank account.

- The Aadhaar card copy must be attached with the application form if it is not linked with the bank account.

- He or she is only eligible to join the scheme through a single bank account if the individual has more than one savings account.

- Rs 12 premium should be paid yearly.

- The program is valid for a year and it needs to be renewed at the end of the year.

- The applicant’s Aadhaar card is the primary KYC document required.

How to register online for PM Suraksha Bima Yojana?

Given down below are the steps to register to the Pradhan Mantri Suraksha Bima Yojna:

1. To opt for Pradhan Mantri Suraksha Bima Yojana the customers can approach either one of the participating banks or an insurance company

2. The subscribers are allowed to take the policy through internet banking by most of the reputed banks

3. Logging into the Internet banking account and enrolling for the scheme is what a subscriber has to do.

4. Message through the subscriber’s registered mobile number to the toll-free numbers of the banks and the insurance companies can be done.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out