Basel III is an expansion of the current Basel II Framework that provides additional capital and liquidity rules to bolster the banking and financial sector’s regulation, supervision, and risk management.

Interest Rates

The interest rate is a fraction of the principal—the money borrowed—that a creditor charges a debtor. The annual percentage rate (APR) is the term that describes the rate of interest on a loan (APR).

An interest rate can even be applied to income made via savings or a certificate of deposit at a bank or credit union (CD). The money gained on such deposit accounts is referred to as the annual percentage yield (APY).

Important Takeaways

- Basel III is an international regulatory agreement that outlines measures aimed at improving banking regulation, supervision, and risk management.

- Banks are required to maintain minimum capital requirements and leverage ratios as a result of the 2008 credit crisis.

- Common equity Tier 1 must be at least 4.5 percent of risk-weighted assets (RWA), Tier 1 capital must be at least 6%, and total capital must be at least 8.0 percent, according to Basel III.

- Both levels have a total minimum capital adequacy ratio of 10.5 percent, which includes the capital conservation buffer.

Basel III Example

Assume Bank A has tier 1 capital of $5 million and tier 2 capital of $3 million. Bank A provided a $5 million loan to ABC Corporation, which has riskiness of 25%, and a $50 million loan to XYZ Corporation, which has riskiness of 55%.

Bank A has $28.75 million in risk-weighted assets ($5 million * 0.25 + $50 million * 0.55). It also has a $8 million capital base ($5 million + $3 million). Its Tier 1 ratio is 17.39 percent ($5 million/$28.75 million * 100), while its overall capital adequacy ratio is 27.83 percent ($8 million/$28.75 million * 100). As a result, Bank A meets the Basel III minimum capital adequacy ratios.

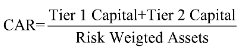

Capital Adequacy Ratio – CAR

The capital adequacy ratio (CAR) is a measure that analyzes a bank’s available capital to its risk-weighted credit risks. The capital adequacy ratio, commonly known as the capital-to-risk weighted assets ratio (CRAR), is used to safeguard depositors and enhance global financial system stability and efficiency.

Minimum Capital Adequacy Ratio Under Basel III

The minimum capital adequacy ratio that banks must maintain under Basel III is 8%. The capital adequacy ratio is a ratio that compares a bank’s capital to its risk-weighted assets. The capital-to-risk-weighted-assets ratio encourages banks throughout the world to have high capitalization and financial resilience in order to withstand economic and financial shocks and crises, such as the global recession of 2008.

Important Takeaways

- CAR is essential for banks to have an adequate cushion to sustain a decent level of losses before going bankrupt.

- Regulators use CAR to measure a bank’s capital adequacy and conduct stress testing.

- CAR is used to assess two forms of capital. Tier-1 capital can take a decent amount of loss without causing the bank to halt trading, whereas tier-2 capital can withstand a loss if liquidation is required.

- The disadvantage of utilising CAR is that it does not take into consideration the possibility of a bank run or what would happen in a financial crisis.

Calculating CAR

Divide a bank’s capital by its risk-weighted assets to get the capital adequacy ratio. There are two layers of capital used to determine the capital adequacy ratio.

Tier 1 capital, also known as core capital, is made up of equity, common stock, intangible assets, and audited revenue reserves. Tier-1 capital is intended to withstand losses without requiring a bank to shut down. Tier-1 capital is capital that is permanently and readily accessible to cushion a bank’s losses without requiring it to cease operations. Ordinary share capital is an excellent illustration of a bank’s tier one capital.

Tier-2 Capital

Unaudited retained profits, unaudited reserves, and general loss reserves make up Tier-2 capital. In the case of a company’s bankruptcy or liquidation, this capital absorbs losses. Tier-2 capital is used to buffer losses in the event of a bank’s failure; therefore it offers less protection to depositors and creditors. It is used to withstand losses if a bank’s Tier-1 capital is depleted.

Tier 1 Capital vs. Tier 2 Capital

The Basel Committee on Banking Supervision established regulatory guidelines for Tier 1 and Tier 2 capital that must be reserved by all financial institutions in the Basel Accords. Tier 2 capital is held to a lesser quality than Tier 1 capital, therefore it is more difficult to liquidate. Hybrid capital instruments, loan-loss and revaluation reserves, as well as unreported reserves, are all included in this category.

The distinction between Tier 1 and Tier 2 capital reserves is the reason for their existence. Tier 1 capital is referred to as “going concern” capital since it is designed to withstand unexpected losses while allowing the bank to continue functioning. Tier 2 capital is defined as capital that has “gone out of business.” These assets are used to alleviate the bank’s commitments before depositors, lenders, and taxpayers are impacted in the case of a bank failure.

Conclusion

The Basel Committee on Banking Supervision designed Basel III as a set of globally agreed-upon policies in response to the financial crisis of 2007-09. The reforms are intended to improve bank regulation, oversight, and risk management.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out