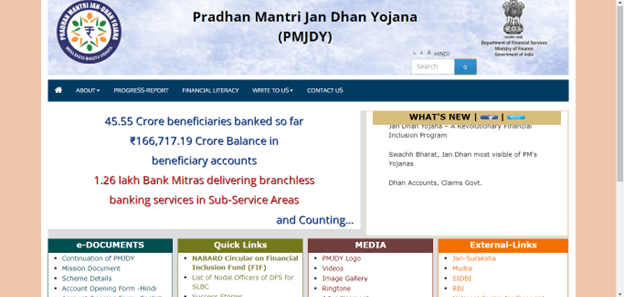

Pradhan Mantri Jan Dhan Yojana

Prime Minister Shri Narendra Modi announced the Pradhan Mantri Jan Dhan Yojana (PMJDY), one of the world’s largest financial inclusion programmes, from the Red Fort’s ramparts on August 15, 2014. The Prime Minister hailed the occasion as a festival to honour the poor’s escape from a vicious cycle when he launched the initiative on August 28th.

Pradhan Mantri Jan Dhan Yojana is a National Financial Inclusion Mission with an integrated approach to achieving comprehensive financial inclusion and providing banking services to all households in the country. The scheme provides access to a variety of financial services, including a basic savings bank account, need-based credit, remittances, insurance, and pensions.

The Jan Dhan Yojana provides a foundation for universal banking access, including at least one basic banking account for each household, financial literacy, and access to loans, insurance, and pensions. It is applicable to both urban and rural locations, and individuals who open an account will receive a local debit card (RuPay card).

Features of PM Jan Dhan Yojana

Following are some of the salient features of the Pradhan Mantri Jan Dhan Yojana:

- RuPay Debit Card is received by every account holder.

- There is no requirement of minimum balance.

- Access to free accident insurance cover of Rs. 1 Lakh.

- Accounts that are opened after 28.08.18 can access accidental cover of Rs. 2 Lakh.

- The amount being deposited in the account earns an interest rate.

Benefits of PM Jan Dhan Yojana

The main benefits of Pradhan Mantri Jan Dhan Yojana are mentioned and described below:

- Deposits made to the scheme’s savings account are rewarded with interest.

- Individuals are not required to maintain a minimum balance in order to participate in the plan. If they want to use check facilities, however, they must keep a minimum balance.

- An overdraft facility is available if people keep their accounts in good standing for six months.

- The RuPay system provides individuals with Accidental Insurance coverage of Rs.1 lakh.

- If the account was started between August 20, 2014, and January 31, 2015, the recipient will be covered for Rs.30,000 in case of death.

- Insurance goods and pension access are available through the programme.

- Individuals who are beneficiaries of government programmes can use the Direct Benefit Transfer option.

- An overdraft facility of Rs.5,000 is provided to one account in the household. The facility is usually provided to the lady in the house.

- Only once the RuPay Card holder has completed a successful non-financial or financial transaction can the Personal Accident protection be claimed. Under the system, transactions made within 90 days of the accident are deemed PMJDY qualifying transactions. The transaction must, however, be completed at an E-COM, POS, ATM, Bank Mitra, or bank branch.

- The mobile banking feature allows account holders to check their balance.

Pradhan Mantri Jan Dhan Yojana - Eligibility

In order to be able to open a Pradhan Mantri Jan Dhan Yojana Account, an individual must be:

- A citizen of India.

- Must not be less than at least 10 years of age.

- Must not possess a bank account.

How to Apply for Pradhan Mantri Jan Dhan Yojana Online?

To open a Jan Dhan Yojana Account Online, we need to follow these steps:

- We need to get the application form (which is both available in Hindi and English) from the official website of Pradhan Mantri Jan Dhan Yojana, i.e., https://www.pmjdy.gov.in/scheme .

![]()

- Now this form needs to be filled up.

- All the necessary documents need to be attached.

- The form is now ready to be submitted.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out