What is Pradhan Mantri Awas Yojana?

Pradhan Mantri Awas Yojana – Urban (PMAYU), the flagship mission of the Government of India, carried out by the Ministry of Housing and Urban Affairs (MoHUA) was launched on June 25, 2015. The mission is to provide Pucca homes to all eligible urban households by 2022 when the country completes 75 years of independence, and cities under the EWS / LIG and MIG categories, including slum dwellers.

Features of PM Awas Yojana

- The program’s interest replenishment rate is up to 6.5% for the mortgages of all beneficiaries who take out a loan for a period of up to 20 years.

- However, interest replenishment depends on your basic income.

- Up to 60,000 rupees per year A 6.5% credit link subsidy will be available for a loan amount of up to 60,000 rupees

- Up to 12,000 Rupees per year Individuals who earn up to 12,000 Rupees per year will receive a 4% interest refund on the loan amount of 9,000 Rupees.

- Up to 18,000 Rupees per year Persons with income categories up to 18,000 Rupees per year receive a 3% subsidy for a loan amount of 12,000 Rupees.

- Additional loans that exceed the subsidized loan amount will be granted at an unsubsidized interest rate

- The PMAY program allows people with disabilities and the elderly to have the privilege of having a home on the first floor.

- The house is built with sustainable eco-friendly technology

Benefits of PM Awas Yojana

PMAY benefits are available when buying a new home from a developer or contractor, or when buying a home for resale. You can also take out a loan to build a house. In addition, it’s interesting to know that PMAY also applies when upgrading a Kutcha home to a Pucca home under the Credit Linked Subsidy Scheme (CLSS) component.

- Scheduled caste and scheduled tribe

- The economically weak part of society (EWS)

- PMAY applies to borrowers who belong to:

- Economically weak sector (EWS with a maximum annual income of 3,000,00 rupees)

- Low-income group (LIG with a maximum annual household income of Rs 6,00,000) and

- Middle-income group (MIG I & II with a maximum annual household income of 18,00,000 Renault)

PM Awas Yojana – Eligibility

- The applicant’s family must not own a home in any part of the country.

- For couples, single or jointly owned transactions are allowed and both options receive only one subsidy.

- The applicant’s family must not benefit from the housing-related program established by the Government of India.

PM Awas Yojana - Eligibility for MIG

- In addition to the EWS and LIG groups, Pradhan Mantri Awas Yojana (PMAY) qualifications extend to middle-class families (MIGI and MIGII).

- Applicants must have an annual family income between Rs. 12 lakh to Rs. 18 lakh,

- A subsidy of up to 2.67 rupees will be paid to the applicant

- Interest rate subsidies are granted for 20 years at a rate of 4% for MIGI and 3% for MIGII.

- Applicants having annual income of Rs. 12 lakh come under M1GI category. They can avail loans up to Rs. 9 lakh.

- Subsidies are pre-deposited into the beneficiary’s loan account, significantly reducing mortgage rates and EMI.

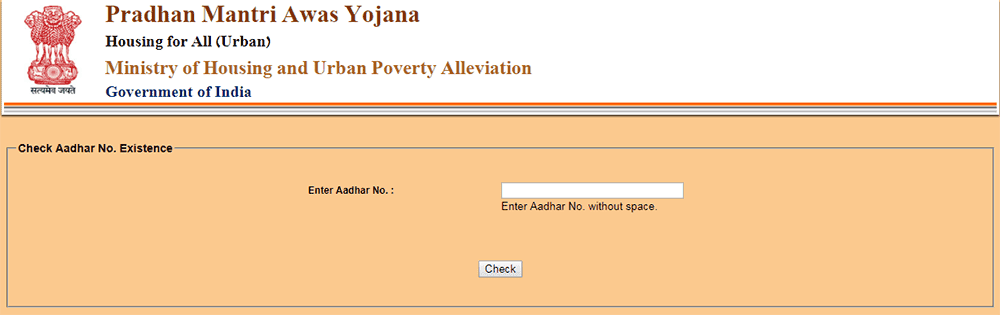

- Aadhaar card is required

PM Awas Yojana - Eligibility for LIG/EWS

- Buying a home can be very expensive, especially in India. However, the Pradhan Mantri Aways Yojna scheme allows you to plan your purchases in the EWS and LIG categories.

- Individuals who fall under the LIG category will have an annual income between Rs. 3 lakh to Rs. 6 lakh.

- Women who belong to EWS/LIG categories will be taken into account if they tend to apply under the PMAY scheme.

- Subsidies are pre-deposited into the beneficiary’s loan account, significantly reducing mortgage rates and EMI.

- Aadhaar card is required

- Applicants must not receive financial assistance from either the central or state governments. India under housing regulations

- The property must belong to a female family

- According to the 2011 census, the location of the property must correspond to the target city and the planned area in the vicinity.

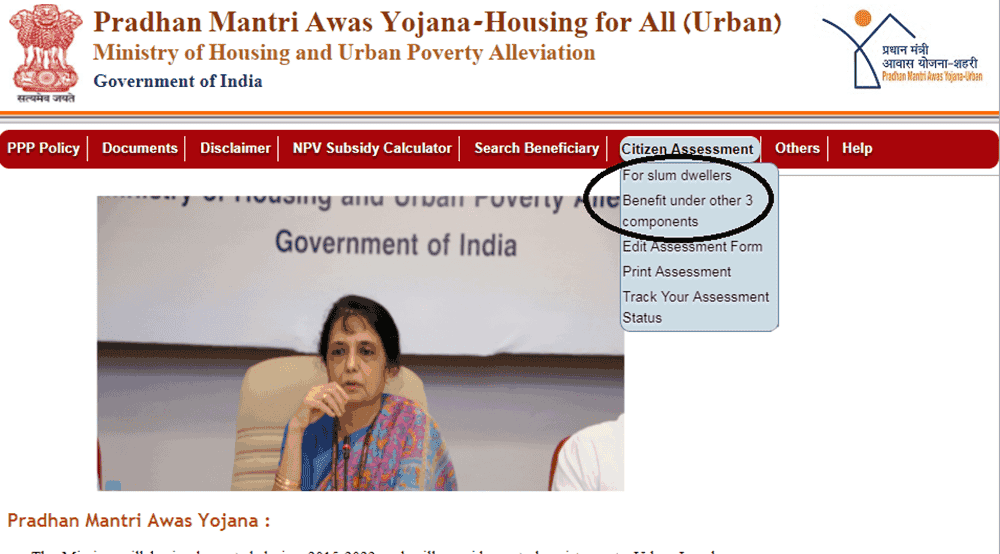

How to apply for PM Awas Yojana online?

The Department of Housing and Urban Development has introduced a simple yet still process that allows people to apply for housing under this system. The form is basically two pages and requires the person to fill in all the important details about himself. The outline of each page is as follows.

Step 1: “Enter your Aadhaar number”. Once the Aadhaar number is confirmed, the application will proceed to the next page. The government uses the Aadhaar number to verify that a person has applied for the system and has not fooled the system.

Step 2: Enter personal information of the applicant. An applicant is required to provide details regarding their current state, the head of the family, current residential address as well as other key information.

Pradhan Mantri Awas Yojana can be applied under two categories:

1. Under other 3 components

The categories such as EWS, MIGs as well as LIGs are known to be beneficiaries under the housing for all by 2022 scheme. The annual income cap is considered as Rs. 3 lakh. The maximum annual income stands between Rs. 3 lakh and Rs. 6 lakh. Along with this, the cap for annual income stands between Rs. 6 lakh and Rs. 18 lakh.

2. Slum dwellers

A slum is known to be an area where 60 to 70 households or around 300 individuals reside in residences that are poorly built. The environment of these regions are considered to be unhygienic. These areas possess shortage of proper infrastructure as well as drinking water and sanitation facilities. The individuals residing in such areas are eligible for applying for the housing for all by 2022 scheme under the Pradhan Mantri Awas Yojana.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out