What is PAN Card?

PAN stands for the Permanent Account Number. PAN card is issued by the Income tax department.

History of PAN in India

Before the concept of the PAN, there was the GIR numbers that were assigned to the various taxpaying entities. It was basically the manual system which was unique under the specific zone or particular assessing officer. However, the number was not unique at the country level. Since GIR was not unique, there could be higher chances of miscalculation and errors or cases of mistaken identity during tax assessment.

The GIR number was allotted by the Assessing Officer to a taxpayer and it included the Assessing Officer’s information as well.

Meanings of Alphabet of PAN Card

Every character in PAN number has a specific relevance Here are the details”

- The first 3 characters: Series of alphabets ranging from AAA to ZZZ.

- 4th Character: The 4th character, segments taxpayers into multiple categories:

- A – AOP (Association of Persons)

- B – BOI (Body of Individuals)

- C – Company

- F – Firm

- G – Government Agency

- H – HUF (Hindu Undivided Family)

- L – Local Authority

- J – Artificial Judicial Person

- P – Individual

- T – Trust

- 5th Character: The 5th character in PAN is the 1st letter of an individual’s surname. So, if anyone is named ‘Sangya Thakur’, the 5th character of his PAN will be ‘T’.

- 6th to 9th Characters: This is from a sequence of numbers between 0001 and 9999.

- Last Characters: Alphabet check letter

Appendix

How to download an E-PAN Card by Name & Date of Birth?

To download the E PAN Card by Name as well as Date of birth, an individual must follow the mentioned steps below :

Step 1: The first step is to visit the official website.

Step 2: Then, click on ‘Know your PAN’ visible on the home page.

Step 3: After this, the next page will display on your screen.

Step 4: Further, you’re required to enter your date of birth, first name, middle name along with the last name in proper manner.

Step 5: Then, fill in the captcha code and submit.

Step 6: Details will be available on the screen.

How to download an E-PAN Card by Aadhar Card?

To download the E PAN Card by Aadhar Card, an individual must follow the mentioned steps below :

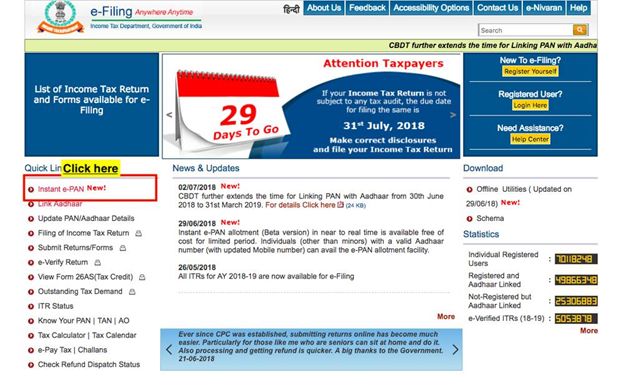

- The first step is to visit the official website, i.e, www.incometaxindiaefiling.gov.in

- Then, you’re required to choose the option of ‘Instant PAN through Aadhar’.

- On the next page, you’re required to fill in your Aadhar card details.

- Then, fill in the captcha and submit.

How to check the status of the E PAN Card?

To check the status of the E PAN Card, one should follow the given steps below :

- The first step is to visit the official website, i.e, www.trackpan.utiitsl.com

- Next, you’re required to enter your application coupon number correctly.

- In case you don’t have this number, then you have the option to file a PAN number.

- After this, you are required to file the Incorporation Agreement as well as DOB.

- Along with this, you’re required to fill the captcha code and submit.

- Lastly, your PAN card will be visible on the screen.

How to check the status of the E PAN Card by Name & DOB?

The status of the E PAN Card can be checked with the help of Name and DOB by the following steps :

- The very first step is to visit the website of Income Tax E-filing.

- Then, you need to select the option ‘Verify your PAN Details’.

- After this, you’re required to enter your name, DOB along with the PAN number on the next page.

- The last step is to fill in the captcha code and then submit it.

- Your details will appear on the screen.

How to check the status of the E PAN Card by Aadhar Card?

The status of the E PAN Card can be checked with the help of Aadhar Card by the following the given steps:

- The first step is to visit the official website.

- After this, you’re needed to enter your 12 digit Aadhar card number.

- Then, fill in the captcha code and submit it.

- Your E PAN Card details will display on the screen.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out