About JAIIB Exams:

The JAIIB exam, an acronym for Junior Associate of the Indian Institute of Bankers, serves as a cornerstone for banking professionals in India seeking to boost their proficiency and career growth. Conducted by the esteemed Indian Institute of Banking and Finance (IIBF), the exam encapsulates a wide array of topics, including intricate banking laws and regulations, comprehensive accounting and finance principles, along with general banking knowledge. This evaluation platform has been meticulously designed to equip banking professionals with the skills and knowledge to execute their duties proficiently.

Benefits of the JAIIB Examination

-

Monetary benefits

-

-

- If you pass the JAIIB Examination and are employed as a bank clerk, you will earn one increment

- You will be eligible for one increment if you pass the JAIIB test given by the IIBF while employed as an officer with a nationalized bank

-

-

Non-monetary benefits

-

- After reading the JAIIB course outline, you will be able to get a thorough understanding of both the practical and technical components of banking in India

- Since the JAIIB credentials have some weight in the promotional interview, having them makes it simpler for you to acquire promotions.

JAIIB Exam Syllabus

The IIBF-recommended syllabus for JAIIB Exam is as follows. It has recently been modified to reflect and accommodate the shifting skill needs of banking professionals. Each paper is further broken down into four modules, the specifics of which are shown below.

PAPER I – INDIAN ECONOMY & INDIAN FINANCIAL SYSTEM

MODULE A: INDIAN ECONOMIC ARCHITECTURE

MODULE B: ECONOMIC CONCEPTS RELATED TO BANKING

MODULE C: INDIAN FINANCIAL ARCHITECTURE

MODULE D: FINANCIAL PRODUCTS AND SERVICES

PAPER II – PRINCIPLES & PRACTICES OF BANKING

MODULE A: GENERAL BANKING OPERATIONS

MODULE B: FUNCTIONS OF BANKS

MODULE C: BANKING TECHNOLOGY

MODULE D: ETHICS IN BANKS AND FINANCIAL INSTITUTIONS

PAPER III – ACCOUNTING & FINANCIAL MANAGEMENT FOR BANKERS

MODULE A: ACCOUNTING PRINCIPLES AND PROCESSES

MODULE B: FINANCIAL STATEMENTS AND CORE BANKING SYSTEMS

MODULE C: FINANCIAL MANAGEMENT

MODULE D: TAXATION AND FUNDAMENTALS OF COSTING

PAPER IV – RETAIL BANKING & WEALTH MANAGEMENT

MODULE A: RETAIL BANKING

MODULE B: RETAIL PRODUCTS AND RECOVERY

MODULE C: SUPPORT SERVICES – MARKETING OF BANKING SERVICES/PRODUCTS

MODULE D: WEALTH MANAGEMENT

JAIIB Exam Schedule/Important Dates

| Events | Date |

| JAIIB 2023 Online Registration Begins | 01st August 2023 |

| JAIIB 2023 Online registration Last Date | 21st August 2023 |

| Last Date to pay the application fee | 21st August 2023 |

| JAIIB Admit Card 2023 | September 2023 |

| JAIIB Exam Date | 08th, 14th, 15th, 29th October 2023 |

JAIIB October 2023 Exam Schedule

| Subject | Date | Total Questions | Duration | Marks |

| Indian Economy & Financial System | 8th Oct 2023 | 100 | 2 Hours | 100 |

| Principles & Practices of Banking | 14th Oct 2023 | 100 | 2 Hours | 100 |

| Accounting & Financial Management of Banking | 15th Oct 2023 | 100 | 2 Hours | 100 |

| Retail Banking & Wealth Management | 29th Oct 2023 | 100 | 2 Hours | 100 |

- The test is objective in nature

- The test comprises 100 questions.

- Each paper is of 100 marks

- The time allotted for each paper is 120 minutes.

- There are no negative marks.

Eligibility and Exam Fees:

(i) The examination is open only to the ordinary members of the Institute (Any person working in the banking and finance industry whose employer is an Institutional member of the Institute can apply for membership. For details visit the IIBF website).

(ii) Candidates must have passed the 12th standard examination in any discipline or its equivalent. The Institute may, however at its discretion, allow any candidate from clerical or supervisory staff cadre of banks to appear at the examination on the recommendation of the Manager of the bank/ officer-in-charge of the bank’s office where the candidate is working, even if he/ she is not 12th standard pass or its equivalent.

(iii) Subordinate staff of recognized Banking/ Financial Institutions in India, who are members of the Institute, are eligible to appear at the examination, provided they have passed the 12th standard or its equivalent.

Registration Fee:

| First attempt fee | Rs.4,000* |

| Second attempt fee | Rs.1,300* |

| Third attempt fee | Rs.1,300* |

| Fourth attempt fee | Rs.1,300* |

| Fifth attempt fee | Rs.1,300* |

* Plus GST as applicable

How to Apply for JAIIB examination

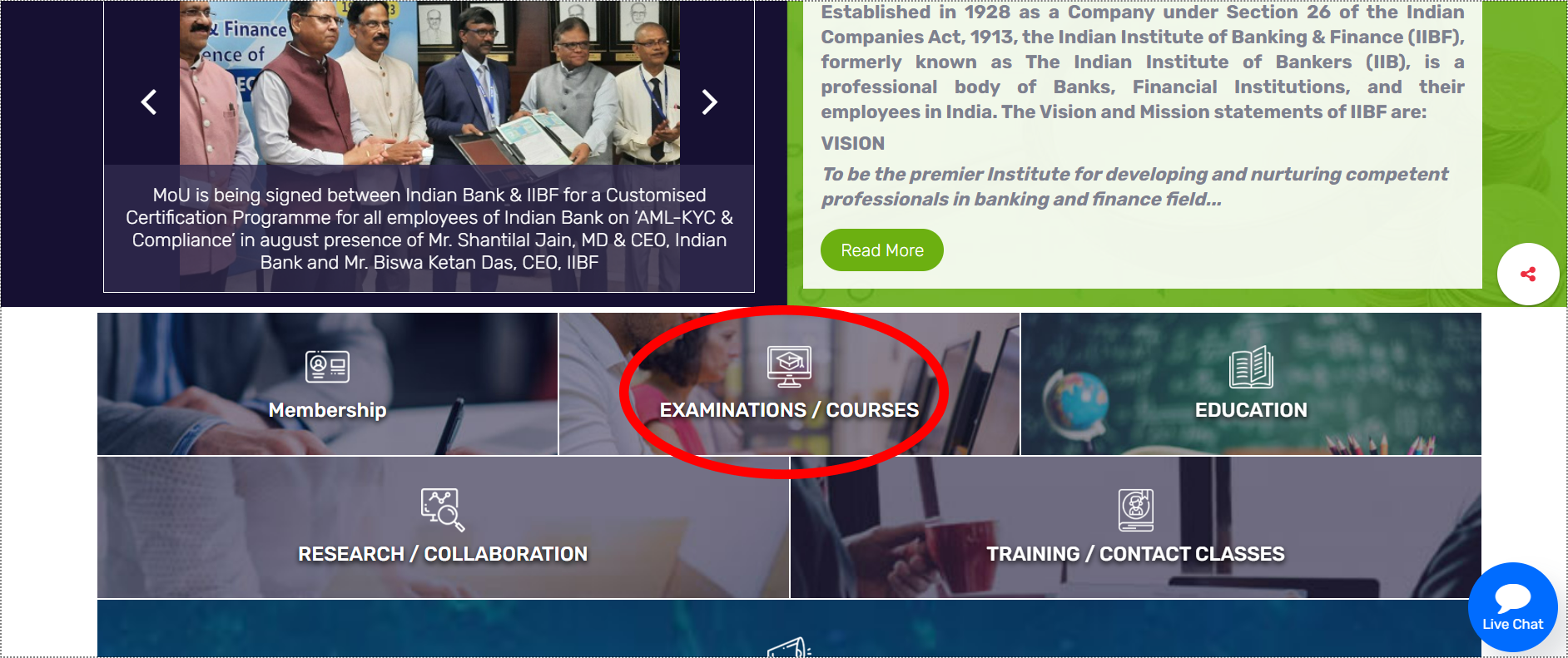

1. Visit https://www.iibf.org.in/

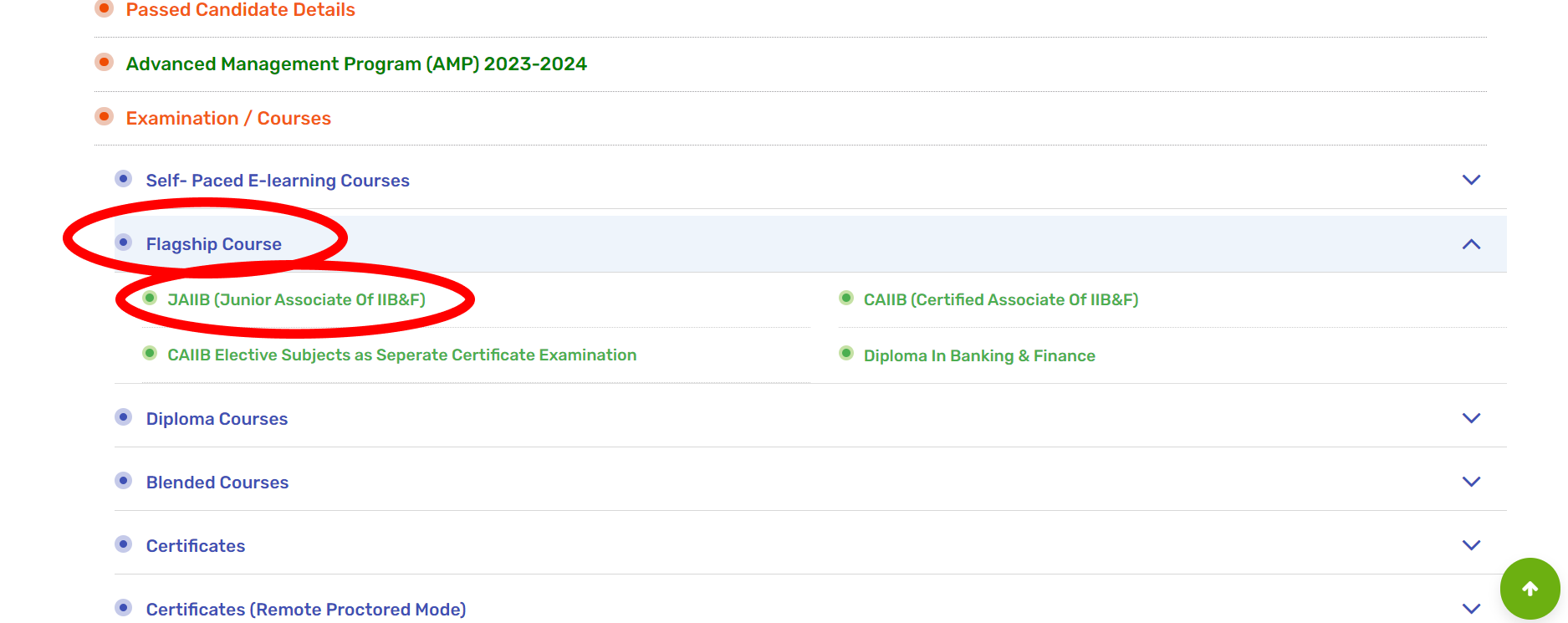

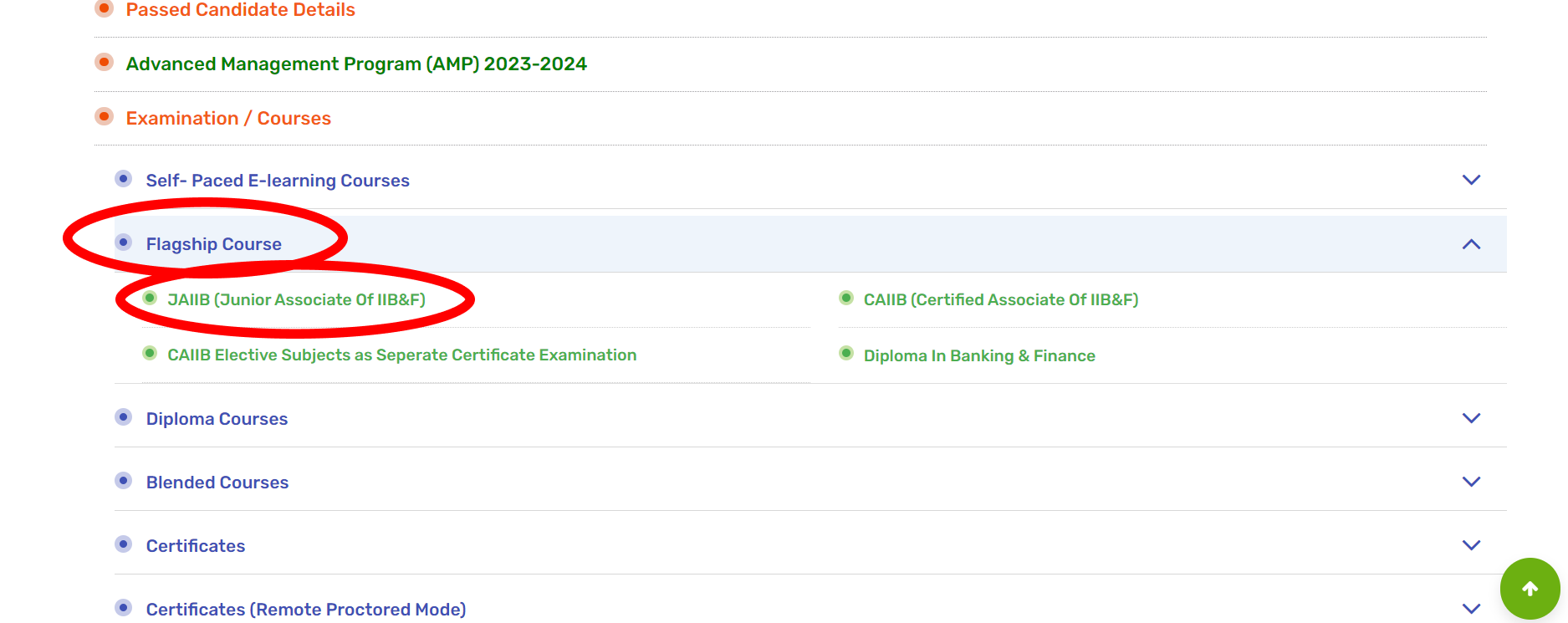

2. Click on the ‘Examination/Courses’

3. Select the option ‘Flagship Courses’

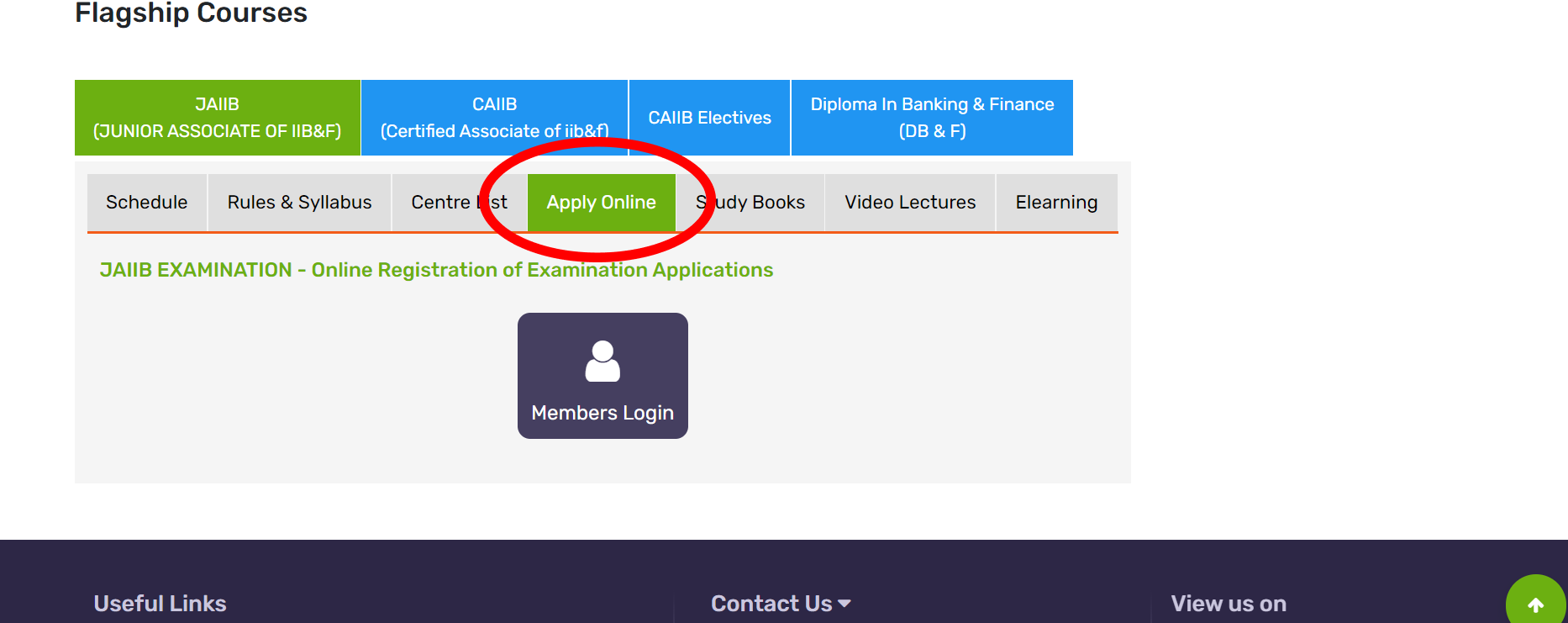

4. Choose JAIIB and log in to proceed with the application.

5. Apply Online

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out