Introduction

Unit price is a system that describes or tells us about the price at which the consumer buys the item in terms of any standard unit. These items can be in per kilogram, cost per gallons, cost per litres, etc., depending upon the item purchased or sold. We can calculate the unit price by correctly deciding the total cost of the product with the quantity they can receive. You can check it on the shelf label of the product. Now, you can compare the unit price of two different packages. This price has great significance for both consumers and organisations selling the products. No one would want to sell their products at a lower price as an organisation. Similarly, any consumer will never want to get a product at a higher price.

Unit Price Formula

The unit price formula is as follows:

Unit price= Unit Cost + Profit Margin

Calculating Unit Price

To calculate unit price, follow the given steps:

- Check the total price and quantity of the product you want to purchase.

- Make sure both of your products have the same unit of measurements in them.

- Find the unit price by dividing the total price by the quantity of the product.

- Calculate the unit price of those goods you want to buy. Choose the product with the lowest unit price.

Unit Cost

The unit cost is the total cost spent by the company in the production and storage of the final item that is readily available for sale. It involves variable cost and fixed cost of the products too.

The formula for the calculation of unit cost involves adding the fixed costs and the variable costs of the products and dividing them by total units produced at a given period.

The formula of unit cost is as follows:

Cost Per Unit = Total Fixed Cost+Total Variable CostTotal number of units produced

Let’s understand fixed costs and variable costs in brief:

- Fixed Costs: As the name says, Fixed costs remain the same (fixed) over a certain period. These costs are unaffected by the numbers of production or sold units by any company over a specific short period. We can say that these costs are not affected by business activities but are affected by period. Examples of fixed costs are Rent, fixed advertisement program, Depreciation, property tax, licence fee etc.

Fixed Cost per Unit=Total Fixed CostTotal numbers of units produced

- Variable Cost: The variable cost differs from fixed cost as it changes and varies. In other words, we can say that variable factors are those factors whose supply can be easily changed in the desired quantity in the short run. Examples of variable costs shall be raw materials and labour.

Unit Elastic

The unit elastic is the term that tells us about the situation in which change in any variable is directly proportional to change of other variables, i.e. elastic. The unit elasticity is the curves having elasticity 1. They have a significant role in describing the supply curves or demand changes.

Solved Questions on Unit Price

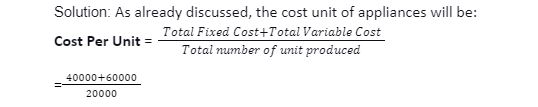

Q 1- A Company in India has a variable cost of ₹ 40000. It has a fixed cost of ₹ 60000 in January, which they incurred on producing on appliances of ₹ 20000. Determine the cost per unit of the appliance.

The cost per unit of appliance =₹ 5 per unit

Q 2- A data of the particular company is given as:

Particular | Amount |

Raw Material | 200 |

Overhead expenses | 500 |

Direct labour | 300 |

Number of Total units produced | 200 |

Profit Margin | 40% |

Find the price per unit of the product if a company wants 20% of the profit?

Solution:

Calculating total cost,

Total cost= Raw Material + Overhead Expenses +Direct Labour

= 200+ 500+ 300

Total cost = ₹1000

Calculating unit cost,

Unit cost= Total CostTotal numbers of units produced

=1000/200

Unit cost =₹5

We know that profit requirement= Profit Margin x cost per unit

=40 x 5%

=₹2

Now, the price per unit shall be= Cost per Unit + Profit Requirement

= 5+2

=₹7

The price per unit of the product if a company wants 20% of the profit is ₹7

Conclusion

Unit price is a system that describes or tells us about the price at which the consumer buys the item in terms of any standard unit. The cost of these items can be in per kilogram, cost per gallons, cost per litres, etc., depending upon the item purchased or sold. This price has great significance for both consumers and organisations selling the products. The unit price formula is Unit price= Unit Cost + Profit Margin. The unit cost is the total cost spent by the company in the production and storage of the final item that is readily available for sale. It involves variable cost and fixed cost of the products too. We know about the significance of unit price and its calculation.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out