Trade discount definition indicates a price reduction that a manufacturer or wholesaler offers to a wholesaler or retailer when they purchase a product or group of products from the manufacturer or wholesaler. In other words, a trade discount is a percentage reduction in the list price of a product that a manufacturer is willing to offer to wholesalers or retailers.

What is Trade Discount

Product catalogues are typically produced by manufacturers and wholesalers for use by customers and vendors to place orders for their products. The prices listed in catalogues are referred to as list prices or manufacturers’ suggested retail prices, depending on who you ask (MSRP). Other businesses within the industry that make use of the manufacturer’s products rarely pay the list price for them. Instead, they negotiate lower prices with the manufacturer. Instead, the manufacturer offers a discount on each purchase or a percentage of the list price to the wholesaler or retailer.

The Difference with Other Discounts

- There are some differences between a trade discount and a sales discount

- A trade discount is not subject to the same restrictions as a purchase discount

- Wholesalers who place large orders for a product, as well as retailers who have established good working relationships with the manufacturer, are typically eligible for trade discounts

- Order quantities do not influence purchase discounts or cash discounts, which are based on payment plans

- Example – The amount of the trade discount varies according to who orders the products and how much they order

- It’s common for manufacturers to offer retailers a trade discount of 5 percent on orders of 100 T-shirts or less

- You can get 12 percent off a thousand t-shirts for wholesalers, on the other hand

- Additionally, trade discounts are based on long-term customer and vendor connections.

Key Points of Trade Discount

- It is frequently permitted in order to enable large-scale sales

- It can be widely permitted for all clients who wish to make large purchases in a single transaction

- In the event of a trade discount, no entry is made in the books of accounts of either the buyer or the seller, as is the case with a cash discount

- It is always debited from the account prior to any form of exchange taking place

- Therefore, it is not recorded in the company’s books of accounts as income or expense.

- It is normally possible to do so at the time of the purchase

- When compared to the number of things purchased and the number of purchases, it is usually lower

Trade Discount Accounting

- A trade discount would not be recorded in the seller’s accounting records, according to the seller

- As an alternative, it would only record revenue in the amount of money that had been invoiced to the customer

- For example, if a seller records the retail price along with a reseller’s trade discount on an invoice to a reseller, the income statement would show an unusually high gross sales amount, which could lead any readers of the financial statements to believe that the manufacturer has a higher sales volume than is actually the case

Trade Discount Journal Entry

It is typically documented in the purchase or sales book, but it is not entered into the ledger accounts, and there is no separate journal entry to reflect this. But when the trade is allowed then it shall be recorded as an expense. However, the following is an example of how a purchase is accounted for in the case of a trade discount.

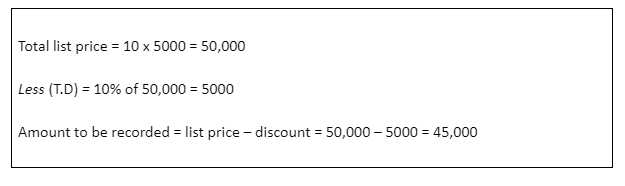

For this example, let us assume that 10 cabinets are acquired from Apex Pvt Ltd. at a list price of Rs. 5000 per item and that a 10 percent discount (trade) is permitted. The following is how the transaction will be recorded in the accounting system:

Advantages of Trade Discount

- Offering trade discounts aids in the promotion of the seller’s company’s products and services

- It increases the number of sales transactions, hence increasing revenue from sales

- Increased sales revenue aids in the recovery of manufacturing-related expenses

- It helps to build the manufacturer’s reputation

- As goods are sold in bulk amounts, this prevents the accumulation of surplus inventory in the manufacturer’s warehouses

Disadvantages of Trade Discount

- In the long run, it may result in a decrease in the seller’s profit margin

- Small discounts can accumulate to produce large sums of money, which would result in a fall in profitability for the company

Application of GST on Trade Discount

According to the GST regulations, there will be no distinction between trade discounts and cash discounts. Whenever a discount is mentioned on the face of an invoice, the discount may be deducted from the taxable value of the items that have been supplied.

Even if the discount is not explicitly stated on the invoice, the discount may still be decreased if the following conditions are met:

- The supplier and the buyer have engaged in a contract that contains a stipulation regarding the discount factor

- The discount is tied to a specific invoice number or invoice number range

- The buyer or user of the supply is responsible for reversing any input tax credit that was incurred as a result of the discount

Conclusion

Manufacturers’ trade discounts assist both manufacturers and retailers/wholesalers. From a manufacturer’s perspective, it increases sales volume and thus profitability. Bulk sales also prevent manufacturers from stockpiling products in their warehouses. It also assists retailers/wholesalers. Conversely, retailers/wholesalers profit handsomely from bulk purchases. They can also give cash discounts to final customers, which helps build client loyalty.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out