Cash Book

A cash book is a financial newspaper that records all cash receipts and expenditures, including deposits and withdrawals from banks. The cash book entries are then transferred to the general ledger.

Breaking Down Cash Book

A cash book is a successor to the general ledger in which all cash transactions conducted during an accounting period are reported in chronological order. The cash book is usually divided into two parts: the cash distribution journal, which records cash payments, and the cash receipts log, which records all cash earned by the company.

Payments made to merchants to reduce accounts payable will be reported in the cash disbursement report, while payments received by consumers on accrued accounts receivable or cash transactions will be included in the cash receipts log. A cash book and a cash account are distinct in some ways.

Cash Account vs. Cash Book

A cash book is a distinct ledger that keeps track of monetary transactions, whereas a cash account is a general ledger account. A cash book acts as both a diary and a ledger, whereas a cash account is structured similarly to a ledger. Information or narrative about the source or usage of monies is required in a cash book, but not in a cash account.

Natural exposure and guarantee of daily cash balances are two reasons why a corporation should disclose transactions using a cash book rather than a cash account.

Verification simply detects errors, and entries are kept up-to-date because the balance is reviewed daily. Balances are normally reconciled for cash accounts at the end of the month, after the monthly bank statement is issued.

Related Terms

Voucher

A voucher is any written documentation that supports the entries reported in the account books and indicates the transaction’s accounting accuracy.

Tender

When it comes to the business world, there is a great deal of dealing and exchanging of goods and services.

Accounting for Costs

Cost accounting is a type of managerial accounting that tries to capture a company’s overall production cost by monitoring both variable and fixed costs, such as a leasing charge.

NPA stands for non-performing assets.

It refers to loans and advances that have defaulted or are behind on their payments and interest payment remained overdue for a period of 90 days.

Coopetition

Coopetition is a term that refers to a situation in which companies compete while also cooperating.

Growth-Share Matrix of BCG

The Growth-Share Matrix, developed by the Boston Consulting Group (BCG), is a planning tool that graphically portrays a company’s products and services in order to help management make informed decisions about what to sell, keep, or invest more in.

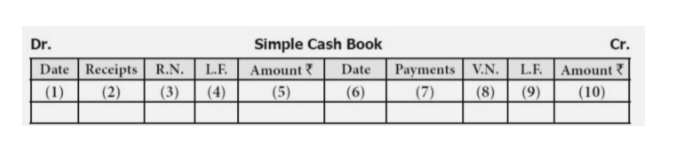

Format Of Simple Cash Book

Cash book with a single column

A single column cash book, also known as a basic cash book, has only one amount column on each side, similar to a ledger account. This book only keeps track of cash transactions. This book keeps track of all cash receipts and payments in a methodical manner. The following is the format of a simple cash book:

The format of a simple cash book reveals that it is split into two sections. The ‘Debit’ column on the left represents all cash receipts, while the ‘Credit’ column on the right represents all cash payments.

Columns (1) and (6) Date: The debit side records the date of receiving cash, while the credit side records the date of paying cash.

Column (2) Receipts: The Receipts column lists the names of people or companies from whom money has been received, as well as income, asset sales such as plants, cash sales, and other receipts.

Column (3) Receipt Number (R.N.): The serial numbers of the cash receipts are stored in this column.

Ledger Folio (L.F.) columns (4) and (9): On both the debit and credit sides of the cash book, this column is available. It serves as a point of reference. This column records the Ledger page number of each account in the cash book. This column aids in the vouching and verification of recorded transactions.

Columns (5) and (10) — Amount: On both the debit and credit sides of the cash book, this is the last column. The amount of actual cash receipts is recorded in the case of cash receipts, and the amount of actual cash payment is recorded in the case of payments. On the debit side, the beginning cash balance is recorded, and on the credit side, the closing cash balance is the balancing amount. The first item on the debit side is the opening balance, or cash provided capital in the case of a new firm, and the last item on the credit side is the closing amount.

On the debit side of the cash book, in the particulars column, the word ‘To’ is traditionally used before distinct accounts. In the particulars column on the credit side of the cash book, the word ‘By’ is used before the various accounts.

Column (7) Payments: This column lists the accounts to which payments have been made, including the names of the people to whom payments have been made, costs paid, assets purchased, cash purchases, and so on.

Column (8) Voucher Number (V.N.): The serial number of the voucher for which payment is made appears in this column.

Conclusion

A cash book is a separate ledger in which all cash receipt and payment transactions are recorded. It is a company’s major storehouse of cash-related information. The data in the cash book is pooled and posted to the general ledger on a regular basis.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out