Every business, regardless of the size, can benefit from incorporating a petty cash fund into their accounting system to cover modest purchases and staff payments. It becomes easier to track tax-deductible spending and separate business and personal expenses if you have a petty cash account which you can use to manage the activities of your company. It’s critical to comprehend petty cash in order to maintain track of your company’s finances more correctly and efficiently.

Petty Cash and Cash Voucher

Petty Cash

Petty cash is defined as a small amount of money kept on hand by a business to cover minor expenses that arise during normal operations. Periodic reconciliations (an accounting process which compares two sets of papers or records to ensure that figures are correct and in agreement) are usually performed on a petty cash fund, and transactions are also noted on the financial statements. Petty cash is typically kept in a drawer or box. Petty cash is a handy way to pay for expenses that are too minor to be covered by a business check. Setting up a petty cash fund allows businesses to keep track of and account for their expenses at a low cost and no administrative effort.

Petty Cash Voucher

A petty cash voucher is a simple form that is used to track petty cash fund disbursements. All petty cash disbursements (payments) must be authorised and substantiated, and all petty cash disbursements must be accompanied by an official receipt of payment from the recipient. For internal control and recordkeeping, they are frequently numbered sequentially. The date of cash pay – out, is the first item on the petty cash voucher. The purpose or description is the second field, which should be filled up according to the company’s policies. The next entry is usually a journal entry that begins with the line “being payment for.” After that, you enter the amount of money paid in both numbers and words.

The petty cash voucher must have the following information:

Date of disbursement

Amount which is disbursed

Person who received the money

Reason for disbursement

General ledger account must be charged

Initials of person disbursing the money from petty cash fund

Auditing the Petty Cash

Unannounced audits and an annual audit are frequently conducted to ensure that existing controls are successful in reducing human errors and preventing misappropriation and waste of petty cash funds. The company’s auditor validates that the available petty cash is correct during unannounced audits by comparing cash and vouchers to the starting petty cash balance.

A company’s standard operating procedures are reviewed once a year, the petty cash custodian is interviewed and observed, and audit trails are created. They might, for example, go over pre-numbered petty cash vouchers to make sure none are missing, and then pick petty cash disbursements and accounting entries at random to go over from beginning to end.

Petty Cash Book

Petty cash book is a chronological record of small cash expenditures. The petty cash book is usually a physical ledger book rather than a digital record. As a result, the book is a manual record-keeping system. Companies are rapidly abandoning all use of petty cash in favour of using company credit cards, so the petty cash book is becoming less important. Some petty cash vouchers are prenumbered, and a number is sometimes issued for control and reference. Petty cash vouchers should be accompanied by receipts or other documentation that justifies the pay – out. The completed petty cash vouchers serve as documentation for replenishment check when the petty cash fund is refreshed.

Accounting for Petty Cash

A debit to record cash received by petty cash clerk (typically in a single block of cash at rare intervals) and a large number of credits to show cash withdrawals from the petty cash fund are the two main types of entries in the petty cash book. These credits can be used to pay for things like food, office supplies, stamps, and so on.

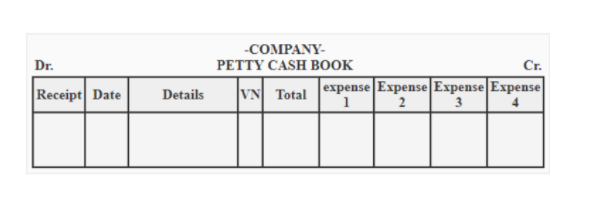

The chief cashier (sometimes recognized as the head or main cashier) is responsible for maintaining the company’s general cash book, in which he records daily receipts and payments totalling hundreds or even thousands of dollars. As a result, he frequently allocates the responsibility for small daily cash transactions to a bookkeeper, receptionist, or another trustworthy employee. A petty cash book, like a standard cash book, has a debit and credit side. The petty cashier records all receipts on debit side and all payments on the credit side of the petty cash book.

Petty Cash Book Format

Conclusion

Petty cash is defined as a small amount of money kept on hand by a business to cover minor expenses that arise during normal operations. A petty cash voucher is a simple form that is used to track petty cash fund disbursements. The petty cash voucher must have the following information: Date of disbursement, Amount which is disbursed, Person who received the money, Reason for disbursement, General ledger account must be charged and Initials of person disbursing the money from petty cash fund. Petty cash book is a chronological record of small cash expenditures.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out