A cheque is written to instruct the bank to pay a certain amount to the payee or beneficiary named on the check. A cheque can be written by either a current or a savings account holder. It’s a type of negotiable instrument that’s utilised to complete a deal.

Cheque

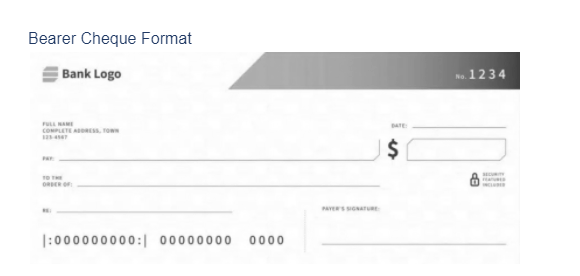

A cheque is a document that authorises the withdrawal of monies from a bank account. A cheque must include the payee’s name, amount to be paid, and the date in order to accomplish this. A cheque is one of the most widely used forms of payment, but its use has decreased as other forms of electronic payment have grown in favour. Typically, a cheque is prepared to approve payment to a single entity, termed as the payee. A cheque can, however, be written to cash, that indicates that the bank will pay the person who delivers the cheque. A cheque is frequently negotiable, meaning the payee can endorse it and assign it to someone else. The new payee is the individual to whom the cheque is assigned. A cheque may include a number of built-in security elements which make it much harder for a forger to change the information on the paper.

Cheque Bearer

A bearer cheque can be made payable in cash or in the name of a specific person. The word ‘bearer’ does not appear on the bearer cheque. Drawee bank pays the cheque to bearer or presenter of the cheque over the counter. A bearer cheque is passed on to someone else. The transferor of a check does not need to endorse check when passing it on. When presenting a bearer check for encashment, the bank does not require any identification. However, if the check amount is significant, the bank may request identification to verify the transaction. To certify the receipt of funds from the bank, the encasher must sign on the back of the bearer cheque.

Cash Payment of Bearer Cheques

The banks are obligated to pay the individual whose name is written on the cheque. As a result, banks require the bearer to sign the back of the cheque as proof that the amount printed on the cheque has been received. This activity was pushed in order to eliminate check fraud that had been occurring previously, as well as to help minimise sharp tactics.

Withdrawal Rules on Bearer Cheques

Handling bearer cheques is risky because the name isn’t printed on the cheque. This means that if a check is lost, the individual who recovers it has the right to receive payment from the bank. Banks have implemented a series of criteria for withdrawing money through bearer cheques in order to limit their use and make them more – safe.

The rules for cheque bearer is given below.

- If an individual’s bearer check is worth more than Rs. 50000, the bank will always request identification verification before disbursing cash. If the person delivering the check is not the account holder, this can happen. If the sum is less than Rs. 50000, however, the bank may or may not require address evidence, even if the person is not the account holder.

- The Reserve Bank of India has mandated it for all banks and warned them against cashing bearer cheques. Before executing a transaction using bearer cheques, banks must require the customer’s KYC verification, according to the RBI.

- If it’s a ‘Bearer’ or ‘Self’ cheque, the bank has no authority to demand the account holder’s presence unless time prevails.

- If the person presenting the bearer check in the bank does not have any address or identity proof, the bank can only make payments over Rs. 50000 with the consent of the bank manager. In this case, the bank manager contacts the account holder to inquire about the transaction, and only then permits it to proceed.

Order Cheque

When the words ‘or Bearer’ are crossed out and the words ‘Or Order’ are written on the cheque, then it is considered an Order Cheque. A particular person on whose name the cheque has been drawn can withdraw cash from this form of check. The cheque recipient just needs to establish his or her identification to the bank by producing a document proving that he or she is the same individual whose name is written on the cheque.

Conclusion

A cheque is a document that authorises the withdrawal of monies from a bank account. A cheque is one of the most widely used forms of payment, but its use has decreased as other forms of electronic payment have grown in favour. A bearer cheque can be made payable in cash or in the name of a specific person. Handling bearer cheques is risky because the name isn’t printed on the cheque. When the words ‘or Bearer’ are crossed out and the words ‘Or Order’ are written on the cheque, then it is considered an Order Cheque.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out