Introduction

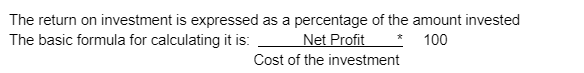

The rate of return on investment (ROI) helps you to select the best investment across different investment options. It is a financial ratio that helps you determine the return on investment against the costs.

Multiple methods are used to calculate the rate of return on investments. The same has been discussed below.

- Accounting Rate of Return (ARR)/ Average Rate of Return (ARR)

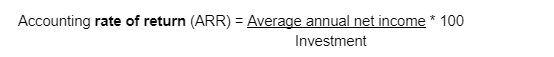

The accounting rate of return of investment measures the average annual net income of the project as a percentage of the investment.

The numerator is the average annual net income generated by the project over its useful life. The denominator can be either the initial investment or the average investment over the useful life of the project.

Advantages of ARR:

- The data required to calculate ARR is readily available.

Limitations of ARR:

- It ignores the time value of money.

- The results may vary depending on the accounting procedures followed.

- It measures profitability and not performance, since it considers net income and not cash flow.

- Internal Rate of Return Method (IRR)

The internal rate of return for an investment proposal is the discount rate that equates the present value of the expected cash inflows with the initial cash outflow. It considers the time value of money, the initial cash investment, and all cash flow from the investment.

This IRR is compared to a criterion rate of return which is the organization’s desired rate of return for evaluating investments. It involves a comparison of IRR with the required rate of return known as the cut-off rate.

Accept the investment if IRR is greater than the cut-off rate.

Reject the investment if IRR is less than the cut-off rate.

Calculation of IRR: The procedures for calculating the internal rate of return is explained below:

Method 1: When Cash inflows are uniform:

Step 1: Calculate the payback period

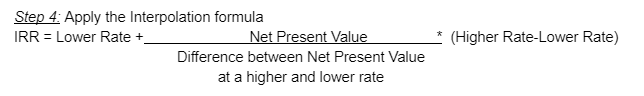

Step 2: Locate this value in PVAF (Present Value Annuity Factor) table corresponding to the period of life of the project. The value may be falling between two discounting rates. IRR lies between these two discounting rates.

Step 3: Discount Cash flows at the two discounting rates and calculate the Net Present Value

Net Present Value = Present Value of Cash Inflow – Present Value of Cash Outflow

Method 2: When Cash Inflows are not uniform

Step 1: Discount the Cash flow at a random rate, say 10%, 15%, or 20% and calculate the Net Present Value.

Step 2: If the NPV is positive, discount the cash flows at a higher rate than the one used before. In case NPV is negative, discount at a lower rate than the one used before. Calculate the NPV using this discount rate.

Step 3: Apply the Interpolation formula and calculate the IRR.

Advantages of IRR:

- It considers the time value of money.

- All the cash flows in the project are considered.

- It can help to understand the desirability of the investment instantly by comparing it with the cost of capital

Limitations of IRR:

- Calculation of IRR is not easy. There can be multiple IRR – its interpretation of which is difficult.

- It assumes that all the future cash inflows are reinvested at a rate equal to the IRR. It ignores a firm’s ability to re-invest at different rates.

- Decisions based only on IRR criteria may not always be correct. For example, a project with a huge investment but lower IRR contributes more in terms of absolute cash flow and increases the shareholders’ wealth.

Conclusion

We have understood the methods of calculating the rate of returns, their formulas, how they can be used for making investment decisions, their advantages and limitations.

ARR is easy to calculate but fails to measure the performance of the investment whereas IRR is complicated to calculate and helps in identifying whether the accept or reject the investment proposals. While making any decisions, one has to use multiple tools and not rely on one single formula as it has its limitations.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out