Preparation of Receipt and Payment Account

To know the use of the accounts, one needs to know the meanings of these terms. What do you mean by receipt and payment account?

Receipts are in the form of cash or bank. Receipts show transactions of how much an organisation or business entity receives in cash or bank from sales or any other source during an accounting year.

Payments are a type of expense or disbursement that is done in either cheques or any mode. Payments as the word suggests are just paying for a desired asset or acquisition and not actually using it further for any other purpose i.e making it an expense.

That takes us towards understanding what receipts and payment accounts do. So, a receipt and payment account is a type of account that is prepared on the very last day of the accounting year. The account records all the cash amounts whether they relate to the previous year, current year or upcoming year, received or paid during an accounting period. These are directly taken from the Cash Book of an accounting year. This account is made by non-profit organisations with the sole purpose of recording transactions, further using it for income and expenditure accounts.

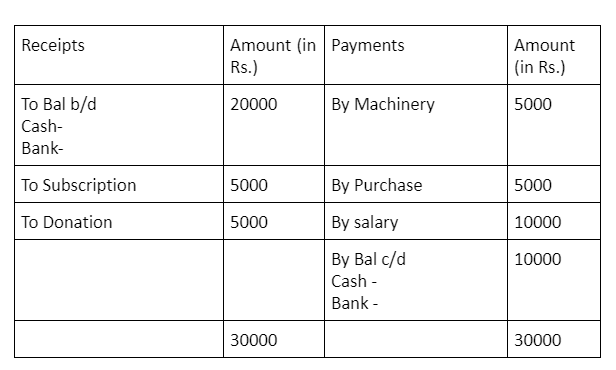

Preparation of Receipt and Payment Account: Examples

Receipt and Payment Account for the year ended

31st March 2021

Dr. Cr.

As mentioned above, receipt and payment account are made for the sole purpose of making an account or bookkeeping all the transactions that happen regarding whatever cash comes in or goes out. The debit side of the account records all the receipt amounts i.e all the cash that flows in. The left-hand side of the account records all the credit transactions under the payments title i.e cash outflow.

For example, The ‘balance b/d’ shows the opening cash figure. Suppose there is a subscription plan by the business and any cash coming in because of that subscription is recorded in the receipts tab as shown “To subscription – Rs. 5000”. To Donation shows a donation amount flowing into business so it is recorded on the debit column as “To donation – Rs. 5000”.

As for the other side, the credit side records all the payments done, i.e outflow of cash. For example, A machinery was bought for Rs. 5000 and is recorded as “By Machinery- Rs. 5000” on the credit side because of the outflow of cash towards machine purchase. Similarly, purchases and salary are made and recorded respectively as “By purchase Rs. 5000, By salary Rs. 10000” because of the outflow of cash.

These recordings of transactions help in keeping an organised form of records that further help in making several different accounts like Income and Expenditure accounts that determine the actual surplus and deficit of a business.

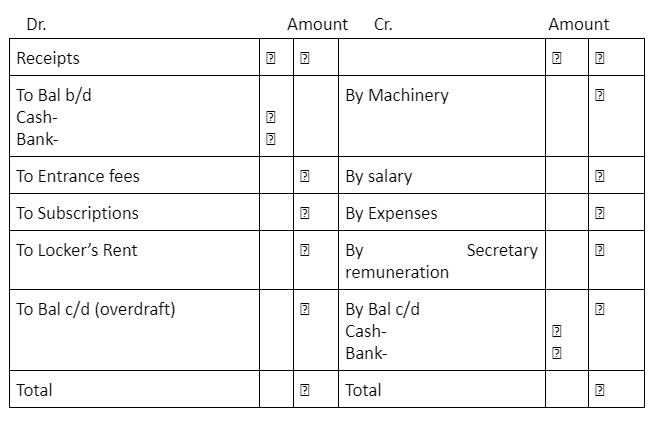

Preparation of Receipt and Payment Account Format

The account records cash like any other and is prepared in this format:

The account starts with an opening balance “To balance b/d” and all the transactions are recorded according to the specified rules. The account ends with “By balance c/d” after the totalling is done. The account mainly ends with a debit side surplus and then adjustments are done on the credit side with “By balance c/d” but when the opposite happens i.e there is a credit surplus the balance adjustment is made on the debit side with the following record “To Balance c/d (overdraft).

Steps involved in Making an Account

Step – 1

Balance of cash in hand and cash at the bank are taken from the cash book and recorded first on the debit side under the receipts column. Any bank overdraft mentioned is to be taken as the first item on credit under the payments column.

Step – 2

Identify the various receipts by taking into account if the mentioned records (for ex- subscriptions) have an inflow of cash. If yes, then record it on the Debit side under the Receipts column.

Step – 3

Identify the various payments by taking into account if the mentioned records (for ex- machinery) have an outflow of cash because of the purchase nature. If yes, then record it on the Credit side under the Payments column.

Step – 4

Make a total of all the transactions recorded on the debit side under the receipts column and make a note. Do the same for the credit side, make a total of all transactions recorded under the payments column and make a note. Compare both sides and mention the bigger number on the total row.

Step 5

If the debit side(receipts) has a bigger number i.e. a surplus amount compared to the credit side then the total of Credit is subtracted from the total of the Debit side and the subtracted amount is written as “By balance c/d – ₹” on the credit side.

If the opposite happens i.e, there is a surplus in credit, the credit total is bigger than the debit total, the debit sum is subtracted from the credit total and the remaining amount is mentioned on the debit side under the following name “To balance c/f (overdraft).

Conclusion

To conclude, this account is just like a cash book that records all the money flowing in and all the money flowing out. No cash items are excluded and only cash and bank items are mentioned. This is mainly done by Non-Profit Organisations (NPO) as a record of maintaining accounts. The account is then further used for making Income and Expenditure accounts so it plays an important role in the whole accounting procedure. To know more about this account and what further uses it has you can read about Objectives of Receipt and Payment Accounting.

Profile

Profile Settings

Settings Refer your friends

Refer your friends Sign out

Sign out